Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Automatic Roll-In (3)

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

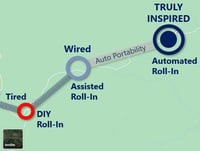

From Tired to Inspired: A Roadmap for 401(k) Roll-Ins

As I wrote in a previous article, 401(k) automated portability is an idea whose time has come. To achieve that vision, how will we get from the present state to full automation of the plan-to-plan roll-in process?

As I wrote in a previous article, 401(k) automated portability is an idea whose time has come. To achieve that vision, how will we get from the present state to full automation of the plan-to-plan roll-in process?

This article, as well as the video below, offers readers a roadmap for the progression from ‘tired’ to ‘wired’ and finally, to the ‘inspired’ state that will eventually characterize 401(k) roll-ins.

‘Sudden Money’ and Preserving 401(k) Savings Don’t Mix

Researchers realize that long-term retirement planning is not a natural act for most 401(k) plan participants. Consequently, important 401(k) plan features have evolved (ex. – auto enrollment, auto escalation, QDIA funds, etc.) to overcome the mis-match and to promote saving for retirement. Many of these features work spectacularly well – but only for as long as participants are actively participating in that plan.

Researchers realize that long-term retirement planning is not a natural act for most 401(k) plan participants. Consequently, important 401(k) plan features have evolved (ex. – auto enrollment, auto escalation, QDIA funds, etc.) to overcome the mis-match and to promote saving for retirement. Many of these features work spectacularly well – but only for as long as participants are actively participating in that plan.

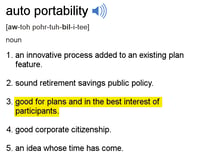

How Auto Portability Serves Participants’ Best Interests - Part 2: An Enhanced Standard of Participant Care

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

Previously, in Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability.

In Part 2, I describe how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of care for participants.

How Auto Portability Serves Participants’ Best Interests, Part 1: Dramatically Improved Participant Outcomes

Plan sponsors considering the adoption of auto portability must determine that, by participating in the auto portability program, they are acting prudently and solely in the interests of their plan’s participants and beneficiaries.

Plan sponsors considering the adoption of auto portability must determine that, by participating in the auto portability program, they are acting prudently and solely in the interests of their plan’s participants and beneficiaries.

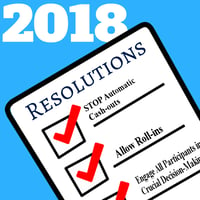

The Most Urgent New Year’s Resolutions for Plan Sponsors

How are you hoping to improve yourself in 2018?

How are you hoping to improve yourself in 2018?

The most common New Year’s resolutions usually have to do with personal appearance, health, or behavior—losing weight, exercising more, dieting, quitting smoking, etc. Popular polls indicate that many of us are after a slimmer, fitter body for ourselves after each New Year’s Day.

Similarly, defined contribution plan sponsors are likely thinking about how they can make their plans more attractive and streamlined in 2018.

The Results Are In: Auto Portability is a Winner!

On November 7th, Retirement Clearinghouse (RCH) issued a press release announcing the results of the first-ever implementation of auto portability, as evaluated by Boston Research Technologies (BRT)’s Warren Cormier in his just-published white paper “Making the Right Choice the Easiest Choice: Eliminating Friction and Leaks in America’s Defined Contribution System.”

On November 7th, Retirement Clearinghouse (RCH) issued a press release announcing the results of the first-ever implementation of auto portability, as evaluated by Boston Research Technologies (BRT)’s Warren Cormier in his just-published white paper “Making the Right Choice the Easiest Choice: Eliminating Friction and Leaks in America’s Defined Contribution System.”

A Big Step Forward for Auto Portability

On July 11th, 2017, a small group of retirement services professionals at Retirement Clearinghouse (RCH) successfully conducted the first-use of a new and important financial technology. Known as “locate & match” -- the technology represents a breakthrough in the ability to automatically move small balances forward in America’s defined contribution system, and forms the backbone of RCH Auto Portability.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?