Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

In-Plan Consolidation

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

The Most Urgent New Year’s Resolutions for Plan Sponsors

How are you hoping to improve yourself in 2018?

How are you hoping to improve yourself in 2018?

The most common New Year’s resolutions usually have to do with personal appearance, health, or behavior—losing weight, exercising more, dieting, quitting smoking, etc. Popular polls indicate that many of us are after a slimmer, fitter body for ourselves after each New Year’s Day.

Similarly, defined contribution plan sponsors are likely thinking about how they can make their plans more attractive and streamlined in 2018.

In Search Of: Guidance for Locating Missing Participants

Two weeks ago, I authored an article applauding the American Benefits Council for their October 2nd, 2017 letter to the Department of Labor (DOL), which clearly identified the root causes of missing participants: a highly-mobile workforce and a lack of retirement savings portability. Extending the Council’s insight, I maintained that what’s really “missing” in our defined contribution system are initiatives that move retirement savings forward when participants change jobs, such as auto portability. When implemented, these initiatives could serve to dramatically decrease the overall incidence of missing participants.

Two weeks ago, I authored an article applauding the American Benefits Council for their October 2nd, 2017 letter to the Department of Labor (DOL), which clearly identified the root causes of missing participants: a highly-mobile workforce and a lack of retirement savings portability. Extending the Council’s insight, I maintained that what’s really “missing” in our defined contribution system are initiatives that move retirement savings forward when participants change jobs, such as auto portability. When implemented, these initiatives could serve to dramatically decrease the overall incidence of missing participants.

Bringing Clarity to the Murky Problem of Missing Participants

On October 2nd, 2017, the American Benefits Council delivered a letter to the Department of Labor (DoL), urging the DoL to act on the problem of unresponsive or missing participants, an issue that has proven to be a significant point-of-pain for plan sponsors.

On October 2nd, 2017, the American Benefits Council delivered a letter to the Department of Labor (DoL), urging the DoL to act on the problem of unresponsive or missing participants, an issue that has proven to be a significant point-of-pain for plan sponsors.

The Explosion of Small 401(k) Accounts

It’s generally accepted that the small-balance accounts of terminated 401(k) plan participants have been a problem for plan sponsors, resulting in increased plan costs, fiduciary risk and other ancillary problems, such as missing participants and uncashed distribution checks.

It’s generally accepted that the small-balance accounts of terminated 401(k) plan participants have been a problem for plan sponsors, resulting in increased plan costs, fiduciary risk and other ancillary problems, such as missing participants and uncashed distribution checks.

Now, based on new information from EBRI and other sources, we’re learning that small accounts are a large and growing problem for active participants as well.

The Fiduciary Rule and Participant Transition Management

Any day now, the Department of Labor will issue the final version of the long-awaited “Fiduciary Rule” which will redefine the term “fiduciary” under ERISA. Much has been written about the impact on advisors and broker-dealers, given their service models to retirement plans.

Any day now, the Department of Labor will issue the final version of the long-awaited “Fiduciary Rule” which will redefine the term “fiduciary” under ERISA. Much has been written about the impact on advisors and broker-dealers, given their service models to retirement plans.

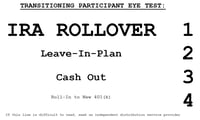

Let a Roll-In Increase Your Retirement Income

In his 10/2/15 MarketWatch article Let a Roll-in Increase Your Retirement Income, RCH President & CEO J. Spencer Williams advises retirement savers to bring their savings with them, vs. leaving their accounts behind -- or worse, cashing out.

In his 10/2/15 MarketWatch article Let a Roll-in Increase Your Retirement Income, RCH President & CEO J. Spencer Williams advises retirement savers to bring their savings with them, vs. leaving their accounts behind -- or worse, cashing out.

Leaving Your 401(k) Savings Behind Will Cost You!

Leaving Your Retirement Savings Behind When You Change Jobs Will Cost You!

Leaving Your Retirement Savings Behind When You Change Jobs Will Cost You!

In his July 30th, 2015 MarketWatch article titled, Leaving Your 401K Behind When Changing Jobs Will Cost You, RCH’s CEO Spencer Williams gives sage advice to America’s mobile workforce, urging job-changing retirement savers to take the initiative and to consolidate their retirement savings.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?