Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

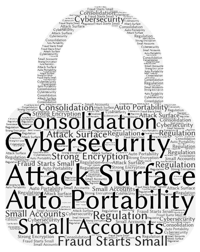

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Managed Portability

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

‘Forgotten’ Accounts: Forget Hyperbole, Here’s a Solution

In October, retirement industry media outlets urgently reported on updated research estimating that there are 31.9 million “forgotten” 401(k) accounts, totaling about $2.1 trillion in assets.

In October, retirement industry media outlets urgently reported on updated research estimating that there are 31.9 million “forgotten” 401(k) accounts, totaling about $2.1 trillion in assets.

Why DEI and ‘Traditional’ Automatic Rollovers Don’t Mix

In the retirement community, momentum is growing to make our 401(k) system more inclusive and to ensure that retirement savings are more equitable.

In the retirement community, momentum is growing to make our 401(k) system more inclusive and to ensure that retirement savings are more equitable.

How Consultants Can Miss the Mark on 401(k) Automatic Rollovers

I'm a big fan of 401(k) plan consultants, who’ve been forceful advocates for the adoption of best practices at leading retirement plan sponsors. So, it’s surprising to me that, when it comes to automatic rollover programs, consultants sometimes miss the mark, at least in terms of participant outcomes.

I'm a big fan of 401(k) plan consultants, who’ve been forceful advocates for the adoption of best practices at leading retirement plan sponsors. So, it’s surprising to me that, when it comes to automatic rollover programs, consultants sometimes miss the mark, at least in terms of participant outcomes.

Three Ways 401(k) Plan Sponsors Can Boost Participants’ Awareness on National Financial Awareness Day

August 14th is National Financial Awareness Day, and 401(k) plan sponsors have been instrumental in increasing the financial awareness of millions of Americans by providing them with access to workplace retirement savings plans that materially enhance their prospects for a timely and comfortable retirement.

August 14th is National Financial Awareness Day, and 401(k) plan sponsors have been instrumental in increasing the financial awareness of millions of Americans by providing them with access to workplace retirement savings plans that materially enhance their prospects for a timely and comfortable retirement.

Consolidation is Vital to Reducing 401(k) Cybersecurity Risk

With $10 trillion in 401(k) and other defined contribution retirement assets to safeguard, retirement industry regulators are intensely focused on the issue of cybersecurity.

With $10 trillion in 401(k) and other defined contribution retirement assets to safeguard, retirement industry regulators are intensely focused on the issue of cybersecurity.

The latest developments signifying regulatory resolve include enforcement actions by the Securities and Exchange Commission (SEC), who in August 2021 sanctioned 8 firms in three separate actions (links here, here and here), for failing to have cybersecurity policies and procedures in place, potentially leading to compromised private client data.

Towards a Sustainable and “Greener” 401(k) System

“America’s retirement system is sustainable” said no one, ever.

“America’s retirement system is sustainable” said no one, ever.

That’s the basis for my somewhat cynical reaction to a February 14th, 2022, Request for Information (RFI) issued by the DOL’s Employee Benefits Security Administration (EBSA). The RFI (Request for Information on Possible Agency Actions to Protect Life Savings and Pensions from Threats of Climate-Related Financial Risk) was issued pursuant to a May 20th, 2021 Executive Order, and asks respondents to identify climate change related threats to “the life savings and pensions of U.S. workers and families.”

Auto Portability Featured in ERISA Advisory Council Report

I’m old enough to remember a time when auto portability was a concept, scarcely worthy of serious attention by practically anyone except a few zealots with an idea.

I’m old enough to remember a time when auto portability was a concept, scarcely worthy of serious attention by practically anyone except a few zealots with an idea.

Five Misconceptions About Automatic Rollovers

Most agree – automatic rollover programs can help plan sponsors deal with problems associated with small-balance accounts, including:

Most agree – automatic rollover programs can help plan sponsors deal with problems associated with small-balance accounts, including:

- High levels of missing participants

- Increased administrative costs and workload

- Increased recordkeeping fees

- Lower average account balances

So Happy Together: Auto Portability & Authorized Portability

When auto portability becomes ubiquitous in America’s 401(k) system, it will herald 100% fully automated, end-to-end portability for all small-balance job-changers.

When auto portability becomes ubiquitous in America’s 401(k) system, it will herald 100% fully automated, end-to-end portability for all small-balance job-changers.

A Happy Ending for Consenting 401(k) Participants

For consenting 401(k) participants, it seems that “happy endings” are possible.

For consenting 401(k) participants, it seems that “happy endings” are possible.

New, compelling data from an ongoing program of portability for small-balance 401(k) job-changers illustrates the effectiveness and appeal of seamless portability, revealing broader implications for auto portability and for all job-changing 401(k) participants, regardless of balance.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?