Plan sponsors considering the adoption of auto portability must determine that, by participating in the auto portability program, they are acting prudently and solely in the interests of their plan’s participants and beneficiaries. In this series, I’ll identify five key reasons why an auto portability program serves the best interests of plan participants.

Plan sponsors considering the adoption of auto portability must determine that, by participating in the auto portability program, they are acting prudently and solely in the interests of their plan’s participants and beneficiaries. In this series, I’ll identify five key reasons why an auto portability program serves the best interests of plan participants.

Part 1 examines the dramatically improved participant outcomes that will result from a program of auto portability.

The Alignment of Fiduciary Purpose with Participant Outcomes

A plan fiduciary’s exclusive purpose, as defined by the Department of Labor (DOL), is to provide benefits to participants and their beneficiaries, while acting solely in their best interests. Therefore, actions that plan sponsors take to improve participant outcomes should closely align with this over-arching purpose.

To demonstrate how a program of auto portability could move the needle on participant outcomes, let’s examine how affected participants could be expected to fare under a program of auto portability, vs. the status quo (no auto portability).

Auto Portability vs. the Status Quo

At a macro level, independent research conducted by the Employee Benefits Research Institute (EBRI) reveals that auto portability, by reducing cashout leakage, could broadly enhance America’s retirement security by:

- Reducing the retirement savings shortfall (RSS) for America’s defined contribution system, by $1.5 to $2.0 trillion.

- Improving the retirement security of gender and generational groups, including Generation Xers (particularly for single and widowed women) and Millennials.

- Augmenting other major retirement public policy initiatives, such as the Automatic Retirement Plan Act (ARPA), where auto portability further reduces the RSS by $287 billion, for households headed by individuals between ages 35-64.

Extending this analysis to participants requires comparing the individual behaviors of 401(k) participants under the status quo vs. the same population’s behaviors under auto portability. The Auto Portability Simulation (APS) was created for this purpose, using discrete event simulation software capable of modelling millions of individual participant decisions, over a 40-year period.

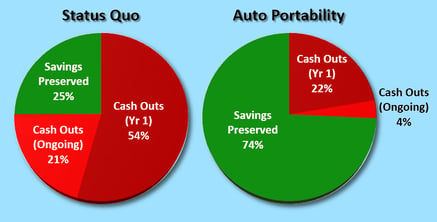

In aggregate, the APS indicates that the “status quo” for small-balance participants is appalling:

- Each year, 5.3 million defined contribution participants with less than $5,000 will change jobs.

- 54% will cash out in the first year following separation. That number rises to 75% after 7 years.

- Only 1-in-4 participants will preserve their savings for retirement.

With auto portability, the APS model predicts vast improvements in participant outcomes:

- Only 26% will cash out over 7 years, a reduction of almost two-thirds.

- 3-in-4 participants will preserve their retirement savings. Of these, 81% will see their balances automatically rolled-in to their new employer’s plan

Figure 1: Aggregate Participant Outcomes

Source: Auto Portability Simulation

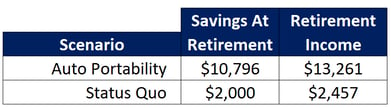

Under a program of auto portability, where the average job-changing participant’s balance is $1,679, a 25-year old participant whose former employer’s plan balance is automatically rolled-in to their next plan would have $16,021 in savings at retirement, yielding $19,680 in retirement income.

Additionally, if the millions of participant outcomes reflected in the APS are probability-weighted, under auto portability the weighted-average participant savings that are preserved for retirement are $10,796 under auto portability, vs. only $2,000 under the status quo.

Table 1: Weighted-Average Participant Results

Source: Auto Portability Simulation

No matter how it’s measured, it’s clear that auto portability would significantly increase participants’ plan benefits that are available for retirement.

Ongoing Monitoring of an Auto Portability Program

A fiduciary is required to exercise diligence in both the initial selection, as well as ongoing monitoring of the performance of an auto portability program.

To validate that an auto portability program is delivering improved outcomes, consider the following success metrics:

- Former participants’ cashout rates, vs. prior experience (if available) or industry standards

- Percentage of former participants’ accounts that are successfully matched or consolidated

- Average duration of safe harbor IRAs

- Volume of new participants rolling in funds from a previous employer via the auto portability program

Acting in the Best Interest of Participants

By adopting an auto portability program, which stands to dramatically improve participant outcomes by increasing the odds that plan benefits will be preserved for retirement, a strong case can be made that a plan sponsor is acting prudently, in the interests of their participants and their beneficiaries, and serving their highest fiduciary purpose.