As I wrote in a previous article, 401(k) automated portability is an idea whose time has come. To achieve that vision, how will we get from the present state to full automation of the plan-to-plan roll-in process?

As I wrote in a previous article, 401(k) automated portability is an idea whose time has come. To achieve that vision, how will we get from the present state to full automation of the plan-to-plan roll-in process?

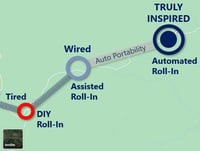

This article, as well as the video below, offers readers a roadmap for the progression from ‘tired’ to ‘wired’ and finally, to the ‘inspired’ state that will eventually characterize 401(k) roll-ins.

Tired: Do-It-Yourself Roll-Ins

If you’re one of those hardy souls who’ve attempted to roll-in a prior employer’s 401(k) balance into your current employer’s plan, you understand how difficult the process can be. Do-it-yourself, or ’DIY’ roll-ins are generally confusing, highly manual, non-standard and are perceived by most participants as not worth the effort or risk.

The types of problems that frequently occur in a DIY roll-in are numerous. We’ve documented two ‘horror stories’ in our Tales from the Roll-In Front Lines series, part 1 and part 2. In fact, the difficulties encountered performing DIY roll-ins largely explain why so few 401(k) plan-to-plan consolidations are attempted.

Unfortunately, this is the grim reality that confronts the vast majority of 401(k) participants today.

Wired: Assisted Roll-Ins

Thankfully, there’s a best practice available now that dramatically improves both roll-in outcomes as well as the participant experience of the roll-in process.

The Assisted Roll-In isolates participants from complexity by pairing workflow technology with expert assistance. By working with a roll-in specialist, participants can rely upon their access to specialized workflow tools, as well as their in-depth experience with roll-ins, both of which are vital to overcoming typical obstacles, increasing accuracy and speeding the process.

The Assisted Roll-In has been a game-changer for job-changing participants, who no longer need to concern themselves with the many vagaries of roll-ins. While there’s still underlying complexity, the roll-in process – from a participant’s perspective – is dramatically simplified. As a result, those participants with access to the Assisted Roll-In undertake roll-ins more frequently and generate far more successful roll-ins to their current 401(k) plans.

Finally, because the Assisted Roll-In uses workflow technology to automate or simplify manual processes, incremental improvements are possible through selected automation & standardization.

Inspired: Automated Roll-Ins

When it arrives, full automation of 401(k) plan-to-plan roll-ins will owe a huge debt to auto portability. Auto portability was designed to fully automate the process of locating, matching and securely transferring participants’ small balances from an old plan to new plan, and it’s easy to see how elements of auto portability’s automation could transform the roll-in process for all participants, all balances.

The Automated Roll-In will fundamentally transform plan-to-plan portability by:

- Utilizing the infrastructure, data security, data exchange and operating standards established by auto portability

- Leveraging auto portability’s network of recordkeepers that have agreed to common rules and protocols for electronic account transfers between plans

- Providing participants with multiple, easy-to-use service channels that promote:

- e-Consent

- Identification of former plan accounts

- Notification & tracking of roll-in status

The Road Ahead

When it arrives, the automation of 401(k) roll-ins will seem like an overnight success. However, those of us who’ve spent many years building solutions, helping overcome regulatory hurdles and advocating for their use know that changes in the retirement sector can often move at a glacial pace, requiring an unusual degree of persistence to bring them to reality. While we acknowledge the tremendous progress that’s been made, we’ll stay focused on the road ahead and won’t rest until the desired future state is reached – where participants can seamlessly move their 401(k) plan balances from employer to employer.