In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

Previously, in Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability.

In Part 2, I describe how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of care for participants.

Making an Existing “Automatic” Better

Auto portability is built on the chassis of another, tried-and-true “automatic” program: automatic rollovers. Automatic rollover programs have existed since 2005, when the Department of Labor’s (DOL) final rules for plan fiduciaries tasked with choosing automatic rollover providers took effect. These rules built upon earlier statutes enacted in the Economic Growth Tax Relief Reconciliation Act, or EGTRRA, passed by Congress in 2001.

Today, the Plan Sponsor Council of America’s (PSCA) 61st Annual Survey finds that 58.1% of plans have provisions for automatic rollovers. For plan sponsors, automatic rollover programs have proven to be effective in removing the small-balance accounts of participants with less than $5,000 from plan rolls, reducing plan costs, while minimizing the administrative burdens and fiduciary risks associated with missing participants.

Unfortunately for participants, today’s automatic rollover programs can result in:

- High-levels of cashouts. Cashout levels of 60% or higher stem from systemic “friction” that participants encounter in moving their small balances forward. The cashout problem is made worse by the practice of automatically cashing out separated participants with balances less than $1,000, which – also according to the PSCA survey – 26% of plan sponsors have adopted.

- Sub-optimal returns. Based on current regulations, automatic rollovers must be sent to a safe harbor IRA, with the IRA investment approved by the plan sponsor and meeting requirements to 1) preserve principle, 2) provide a reasonable rate of return and 3) that is consistent with liquidity. Offering safe harbor IRA accountholders with the opportunity to transfer their balances into more-suitable long-term investment options is nice, but has little practical impact, as only 6 in 1,000, or 0.6% of these accountholders will take this step.

- Excessive and/or hidden fees. Fees for miscellaneous services, such as QDROs, address searches, and paper statement fees, combined with account maintenance and distribution fees, can outpace the earnings from default investments, leading to depleted balances.

- A proliferation of “stranded” or forgotten small-balance safe harbor IRA accounts. For many accountholders, these balances can become an afterthought, or forgotten altogether. To make matters worse, safe harbor IRA providers will often erect administrative barriers that discourage movement of funds out of the safe harbor IRA, such as requiring a signature guarantee.

Auto Portability: An Enhanced Standard of Participant Care

A program of auto portability, as represented in the DOL’s Advisory Opinion 2018-01A, establishes an enhanced standard of care for separated participants who are subject to a plan’s automatic rollover provisions.

The key elements of the new standard that are protective to participants include:

- Minimizing the time spent in a safe harbor IRA.

Under auto portability, a safe harbor IRA becomes a transitional account, intended to accommodate a job-changer’s retirement savings only for as long as necessary to consolidate their savings. Consolidation can occur automatically, via an electronic locate-and-match process that finds the former participant’s new plan account with a participating recordkeeper, or when a participant simply requests a transfer. Either way, the consolidation process is made easy, and the time spent in a safe harbor IRA is minimized. - Eliminating the need to cash out balances less than $1,000.

Under auto portability, balances below $1,000 can be automatically rolled over and be eligible for consolidation, preserving their tax-deferred status. Plan sponsors also benefit from this feature, as they generally see a marked decrease in the incidence of uncashed distribution checks, which are considered a plan asset until they’re resolved. - Enhancing participant communication and disclosure, delivered during all phases of the process.

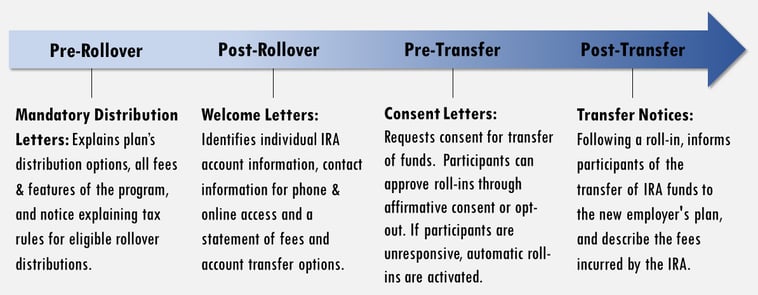

Auto portability has defined an essential program of participant communications and disclosure that’s informative, protective and designed to be easily-understood. Critical participant communication is delivered at four key phases of the process, as shown in Figure 1 below.

Figure 1: Auto Portability Participant Communication

- Formally integrating a robust address location search

Under auto portability, when a safe harbor IRA account is initially established, a standardized automated address search will be conducted, which includes a search of internal program databases, the National Change of Address (NCOA) database, and two commercial database searches. If the automated searches do not yield a valid address, the program triggers a manual, internet-based search. - Establishing a transparent, simple & straightforward fee structure.

All fees under auto portability are first required to be disclosed to, and approved by, the plan sponsor.

There are four participant-paid auto portability program fees, including:

- A one-time communication fee

- A monthly account administrative fee

- A distribution fee, if the IRA is closed and the participant cashes out or transfers the balance to another plan

- A roll-in fee, if the IRA is closed and the account balance is rolled in to a new employer plan, with assistance

Finally, all fees charged to the safe harbor IRA are frozen at the time the decision is made to transfer the assets to the individual's current employer plan.

Auto Portability: A Much-Needed Upgrade to Automatic Rollover Programs

By delivering an enhanced standard of care for participants, auto portability represents a much-needed and significant “upgrade” for automatic rollover programs – one that plan sponsors should feel confident will be in the long-term best interests of their plan’s participants.