Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Retirement Savings Portability (3)

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

Don’t Relegate Lost & Missing Accounts to the Lost & Found—Consolidate Them in the Retirement System

The Securing a Strong Retirement Act of 2021, nicknamed the “SECURE (Setting Every Community Up for Retirement Enhancement) Act 2.0,” was passed unanimously by the House Ways and Means Committee, and many expect the bill to pass the full House of Representatives.

The Securing a Strong Retirement Act of 2021, nicknamed the “SECURE (Setting Every Community Up for Retirement Enhancement) Act 2.0,” was passed unanimously by the House Ways and Means Committee, and many expect the bill to pass the full House of Representatives.

How Sponsors can Facilitate Better Participant Outcomes—and Improve Plan Metrics—in 2021

Elections Have Consequences—Elect to Help Participants Keep Their Savings, Instead of Losing Their Savings via Mandatory Distributions

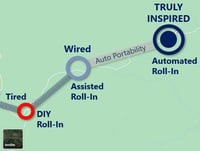

From Tired to Inspired: A Roadmap for 401(k) Roll-Ins

As I wrote in a previous article, 401(k) automated portability is an idea whose time has come. To achieve that vision, how will we get from the present state to full automation of the plan-to-plan roll-in process?

As I wrote in a previous article, 401(k) automated portability is an idea whose time has come. To achieve that vision, how will we get from the present state to full automation of the plan-to-plan roll-in process?

This article, as well as the video below, offers readers a roadmap for the progression from ‘tired’ to ‘wired’ and finally, to the ‘inspired’ state that will eventually characterize 401(k) roll-ins.

Every Dollar Counts in Today’s Zero-Interest-Rate Environment

It’s no secret that interest rates have been at historically low levels for quite some time, but the recent announcement by Federal Reserve Chairman Jerome Powell indicates that rates will stay near zero for the foreseeable future. Chairman Powell stated in his address last month that the Fed would tolerate above-2% inflation instead of attempting to preemptively control inflation by raising interest rates.

It’s no secret that interest rates have been at historically low levels for quite some time, but the recent announcement by Federal Reserve Chairman Jerome Powell indicates that rates will stay near zero for the foreseeable future. Chairman Powell stated in his address last month that the Fed would tolerate above-2% inflation instead of attempting to preemptively control inflation by raising interest rates.

How to Mitigate COVID-19’s Potentially Catastrophic Impact on Americans’ Retirement Readiness

It’s bad enough that more than 50 million Americans have filed claims for unemployment benefits since the start of the COVID-19 pandemic and lockdown. But in addition to the disruption, financial hardship, and uncertainty that unemployed Americans (and their families) are experiencing right now, this crisis also threatens their financial security during retirement.

It’s bad enough that more than 50 million Americans have filed claims for unemployment benefits since the start of the COVID-19 pandemic and lockdown. But in addition to the disruption, financial hardship, and uncertainty that unemployed Americans (and their families) are experiencing right now, this crisis also threatens their financial security during retirement.

COVID-19 Pandemic Demonstrates the Need for Institutionalized Portability

The COVID-19 crisis has created a situation where tens of millions of American workers are in danger of seeing their retirement savings depleted. In addition to the awful death toll, the COVID-19 outbreak has led to extreme disruption in daily life, financial markets, and the economy—especially employment. As of May 28, more than 40 million Americans filed claims for unemployment benefits in the previous 10 weeks. This deadly combination of 1) levels of unemployment not seen since the Great Depression, 2) a significant market downturn, and 3) the ongoing plan-to-plan portability gap, has serious implications for these Americans’ retirement outcomes.

The COVID-19 crisis has created a situation where tens of millions of American workers are in danger of seeing their retirement savings depleted. In addition to the awful death toll, the COVID-19 outbreak has led to extreme disruption in daily life, financial markets, and the economy—especially employment. As of May 28, more than 40 million Americans filed claims for unemployment benefits in the previous 10 weeks. This deadly combination of 1) levels of unemployment not seen since the Great Depression, 2) a significant market downturn, and 3) the ongoing plan-to-plan portability gap, has serious implications for these Americans’ retirement outcomes.

To Show Participants You Care, Help Them Avoid Cashing Out Post-CARES Act

It goes without saying that we are not living in normal times. The health and safety of our families and communities are paramount, and measures to ease burdens and hardships are always appreciated. These include the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the massive fiscal stimulus signed into law on March 27, 2020.

It goes without saying that we are not living in normal times. The health and safety of our families and communities are paramount, and measures to ease burdens and hardships are always appreciated. These include the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the massive fiscal stimulus signed into law on March 27, 2020.

Think Twice Before Tapping Your 401(k) for Short-Term Needs

In extraordinary times like these, it is understandable that Americans need emergency cash injections to pay expenses. But before tapping their 401(k)s, workers should at least follow the advice offered by the old saying “think twice,” and consider all sources of short-term cash, before prematurely cashing out their 401(k) savings (WSJ: “The Emergency 401(k) Button,” March 20). Even if tax and other penalties on 401(k) cash-outs during this period are waived, Americans who cash out forfeit the additional savings which the sums they receive would have accrued by retirement, had they remained incubated in the U.S. retirement system.

In extraordinary times like these, it is understandable that Americans need emergency cash injections to pay expenses. But before tapping their 401(k)s, workers should at least follow the advice offered by the old saying “think twice,” and consider all sources of short-term cash, before prematurely cashing out their 401(k) savings (WSJ: “The Emergency 401(k) Button,” March 20). Even if tax and other penalties on 401(k) cash-outs during this period are waived, Americans who cash out forfeit the additional savings which the sums they receive would have accrued by retirement, had they remained incubated in the U.S. retirement system.

The Institutionalization of Portability is Key to Reducing Cash-Out Leakage

Although defined contribution plan recordkeepers and sponsors have made considerable progress helping participants retain savings through reduced fees over the past decade, job-changing participants’ 401(k) savings account balances remain in a state of dangerous limbo, as participants often succumb to the temptation of cashing out. EBRI reports that at least 4.5 million—or 40%—of job-changing participants cash out $92.4 billion in 401(k) savings from the U.S. retirement system every year.

Although defined contribution plan recordkeepers and sponsors have made considerable progress helping participants retain savings through reduced fees over the past decade, job-changing participants’ 401(k) savings account balances remain in a state of dangerous limbo, as participants often succumb to the temptation of cashing out. EBRI reports that at least 4.5 million—or 40%—of job-changing participants cash out $92.4 billion in 401(k) savings from the U.S. retirement system every year.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?