It’s bad enough that more than 50 million Americans have filed claims for unemployment benefits since the start of the COVID-19 pandemic and lockdown. But in addition to the disruption, financial hardship, and uncertainty that unemployed Americans (and their families) are experiencing right now, this crisis also threatens their financial security during retirement.

It’s bad enough that more than 50 million Americans have filed claims for unemployment benefits since the start of the COVID-19 pandemic and lockdown. But in addition to the disruption, financial hardship, and uncertainty that unemployed Americans (and their families) are experiencing right now, this crisis also threatens their financial security during retirement.

As I have written many times before in this column, defined contribution plan participants will seriously diminish their retirement savings if they prematurely cash out all or part of their 401(k) savings account balances. According to our research, a hypothetical 30-year-old who cashes out a 401(k) account with $5,000 today would forfeit up to $52,000 in earnings they would have accrued by age 65, if we assume the account would have grown by 7% per year. In addition, the Employee Benefit Research Institute (EBRI) estimates that the average American worker will change employers 9.9 times over a 45-year period. With at least 33% and as many as 47% of plan participants cashing out their retirement savings following a job change, according to the Savings Preservation Working Group, that means workers switching jobs could cash out as many as four times over a working career, devastating their ability to fund a secure retirement.

Even before COVID-19 and “social distancing” became part of the national lexicon, cash-outs posed a huge problem to Americans’ retirement prospects. At the beginning of this year, EBRI estimated that the U.S. retirement system loses $92 billion in savings annually due to 401(k) cash-outs by plan participants after they change jobs.

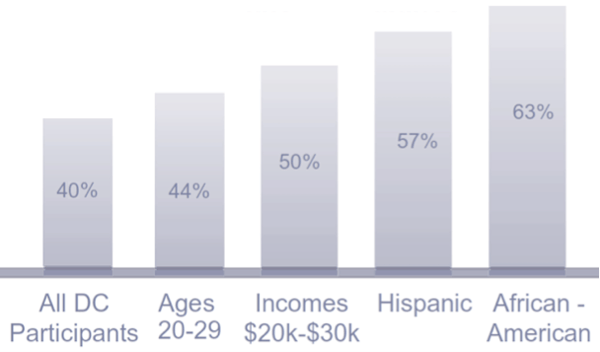

When we correlated EBRI data with research from other sources, we also concluded that the most vulnerable—including minorities and low-income workers—are at much higher risk of cashing out. While 33% to 47% of all job-changing participants cash out within one year of switching employers, that statistic rises to 63% for Blacks and 57% for Hispanics, and to 50% for those earning between $20,000 and $30,000 per year.

Participants Cashing Out Up to 1 Year After Changing Jobs

Sources: EBRI, Fidelity, and Ariel/Aon Hewitt

These alarming trends were uncovered long prior to the pandemic and lockdown. Since the start of the COVID-19 outbreak, the Coronavirus Aid, Relief, and Economic Security (CARES) Act stimulus has temporarily eased limits, penalties, and taxes on early withdrawals from retirement savings accounts made by December 31, 2020. While the CARES Act measures are clearly well-intentioned, participants who take advantage of these provisions risk creating a long-term problem while resolving short-term liquidity needs.

Heightening the temptation to make 401(k) withdrawals is the recent expiration of another CARES Act provision—the extra $600 weekly payments to Americans who lost their jobs due to the COVID-19 pandemic. These additional federal unemployment benefits expired at the end of July, and as of this writing no deal to extend them has been reached in Congress. For Americans who had been relying on this benefit, or continue to experience financial hardship and stress about paying expenses, it is understandable that 401(k) savings could look like an attractive source of emergency liquidity.

However, given the long-term damage that cash-outs inflict on retirement outcomes, plan sponsors and recordkeepers should take this opportunity, as fiduciaries, to educate their current and terminated participants about the importance of tapping into their 401(k) savings only as an absolute last resort.

Institutionalizing Portability can Help

The lack of a seamless process for transporting 401(k) assets from job to job causes many participants to view cashing out as the most convenient option. And without an easy way to locate the mailing addresses of lost and missing terminated participants, sponsors and recordkeepers are unable to ensure holders of small accounts receive notifications about the status of their plan benefits.

Fortunately for participants, sponsors, and recordkeepers, technology solutions enabling the institutionalization of plan-to-plan asset portability have been live for three years. These innovations include auto portability, the routine, standardized, and automated movement of a retirement plan participant’s 401(k) savings account from their former employer’s plan to an active account in their current employer’s plan.

Auto portability is powered by “locate” technology and a “match” algorithm, which work together to find lost and missing participants, and initiate the process of moving assets into active accounts in their current-employer plans.

By adopting auto portability, sponsors and recordkeepers can not only discourage participants from cashing out, but also eliminate the need for automatic cash-outs. And these advantages come at a time when the hard-earned savings of tens of millions of Americans are at risk of being removed from the U.S. retirement system.

Before the COVID-19 pandemic, EBRI estimated that if all plan participants had access to auto portability, up to $1.5 trillion in savings, measured in today’s dollars, would be preserved in our country’s retirement system over a 40-year period. Now more than ever, the institutionalization of portability by sponsors and recordkeepers is essential for helping Americans achieve financial security in retirement.