Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

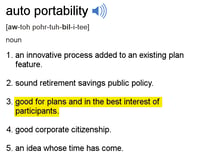

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

Spotlight on Cashout Leakage: The Fundamentals

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

The first of a five-part series, this article addresses the fundamentals of cashout leakage.

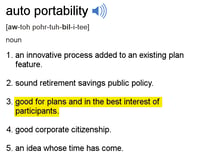

How Auto Portability Serves Participants’ Best Interests: Part 5

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

Previously: In Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability. In Part 2, I described how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of participant care. In Part 3, I presented evidence that the adoption of auto portability could lead to a reduction in plan expenses. In Part 4, I addressed how auto portability could enhance 401(k) participants’ financial wellness.

In part 5, my final installment of the series, I explain how auto portability can mitigate retirement-related cybersecurity risks.

How Auto Portability Serves Participants’ Best Interests - Part 4: Auto Portability Enhances Participants' Financial Wellness

In this five-part series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this five-part series, I identify five key reasons why an auto portability program serves the best interests of plan participants. Previously:

- In Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability.

- In Part 2, I described how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of participant care.

- In Part 3, I presented evidence that the adoption of auto portability could lead to a reduction in plan expenses.

In Part 4, I address how auto portability could enhance 401(k) participants’ financial wellness.

A Plan Metric Every Sponsor Should Track: Participant-Retained Retirement Savings

When evaluating their defined contribution plans, plan sponsors understandably look at standard benchmarks such as rate of participation, average deferral percentage, and average account balance. However, given the highly mobile nature of today’s American workforce, sponsors should also consider tracking the average percentage of retirement savings that participants retain during their job tenure, and when they leave to join another employer.

LIMRA Webinar Features Michael Kreps’ Update on Auto Portability

On April 16th, as part of their Strategic Issues Webinar Series, the LIMRA Secure Retirement Institute delivered the webinar Regulatory and Legislative Trends Impacting the U.S. Retirement System. The LIMRA webinar featured presenter Michael Kreps, Principal, Groom Law Group, and was moderated by Judy Zaiken, Corporate Vice President, LIMRA.

On April 16th, as part of their Strategic Issues Webinar Series, the LIMRA Secure Retirement Institute delivered the webinar Regulatory and Legislative Trends Impacting the U.S. Retirement System. The LIMRA webinar featured presenter Michael Kreps, Principal, Groom Law Group, and was moderated by Judy Zaiken, Corporate Vice President, LIMRA.

EBRI Webinar Examines Impact of Tenure on Retirement Savings

On April 10th, the Employee Benefit Research Institute (EBRI) featured the webinar EBriefing: Trends in Employee Tenure, showcasing the latest EBRI research examining broad employee tenure trends over time, and the impact that shorter tenure can have on retirement savings.

On April 10th, the Employee Benefit Research Institute (EBRI) featured the webinar EBriefing: Trends in Employee Tenure, showcasing the latest EBRI research examining broad employee tenure trends over time, and the impact that shorter tenure can have on retirement savings. The webinar’s presenters included Craig Copeland, Senior Research Associate, EBRI and Spencer Williams, President & CEO, Retirement Clearinghouse (RCH), and was moderated by Stacy Schaus, Founder & CEO, Schaus Group LLC.

America's 401(k) System is Unsustainable - Let's Fix It

On Earth Day 2019, as we focus on creating a sustainable and eco-friendly environment, it's worth considering how the application of similar principles would benefit our retirement system. America’s 401(k) system is unsustainable – urgently requiring an upgrade to effectively deliver on its intended goal – helping millions of Americans enjoy a timely and comfortable retirement. The good news is that we're beginning to see important signs of action that could ultimately address the problem.

On Earth Day 2019, as we focus on creating a sustainable and eco-friendly environment, it's worth considering how the application of similar principles would benefit our retirement system. America’s 401(k) system is unsustainable – urgently requiring an upgrade to effectively deliver on its intended goal – helping millions of Americans enjoy a timely and comfortable retirement. The good news is that we're beginning to see important signs of action that could ultimately address the problem.

How Auto Portability Serves Participants’ Best Interests - Part 3: Auto Portability Could Lower Plan Expenses

In this five-part series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this five-part series, I identify five key reasons why an auto portability program serves the best interests of plan participants. Previously:

- In Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability.

- In Part 2, I described how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of participant care.

In Part 3, I present evidence that the adoption of auto portability could lead to a reduction in plan expenses.

Cybersecurity is Augmented by Auto Portability

All companies that manage personal consumer data, regardless of where they are based or what industry they are part of, are right to be concerned about cybersecurity. The scope and scale of cyberattacks continue to increase around the world, as last year’s breach compromising 50 million Facebook users demonstrated.

Tax Day is Coming—Encourage Millennial Participants to Incubate Saver’s Credits

April 15 is just around the corner. While many Americans dread Tax Day, April 15 presents defined contribution plan sponsors with an opportunity to demonstrate their value as fiduciaries, and as financial wellness advocates.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?