Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

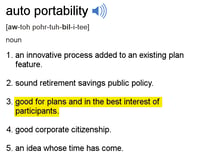

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

401k Consolidation (6)

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

The Surprising Migratory Patterns of Job-Changing Participants

Much has been written in the media, including this column, about the increase in mobility of today’s American workforce.

Much has been written in the media, including this column, about the increase in mobility of today’s American workforce.

The Auto Portability Imperative

An Important Milestone: The DOL Issues Final Prohibited Transaction Exemption for Auto Portability

On July 31st, the U.S. Department of Labor (DOL) released the final Prohibited Transaction Exemption (PTE) to Retirement Clearinghouse (RCH) for the RCH Auto Portability program, completing the regulatory framework and clearing the way for auto portability’s widespread adoption.

On July 31st, the U.S. Department of Labor (DOL) released the final Prohibited Transaction Exemption (PTE) to Retirement Clearinghouse (RCH) for the RCH Auto Portability program, completing the regulatory framework and clearing the way for auto portability’s widespread adoption.

This new development represents an important milestone on the path to auto portability, a private-sector innovation that will help prevent 401(k) cashout leakage, increase plan efficiencies and improve the prospects of a timely, comfortable and secure retirement for millions of Americans.

What’s Missing from the SECURE Act? A Provision to Plug Cash-Out Leakage

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, passed by the House of Representatives on May 23, has the potential to make a positive impact on Americans’ retirement readiness. One of the bill’s key provisions involves removing restrictions on open multiple employer plans (MEPs), which would make it less costly for small businesses to offer retirement savings plans to employees.

A Plan Metric Every Sponsor Should Track: Participant-Retained Retirement Savings

When evaluating their defined contribution plans, plan sponsors understandably look at standard benchmarks such as rate of participation, average deferral percentage, and average account balance. However, given the highly mobile nature of today’s American workforce, sponsors should also consider tracking the average percentage of retirement savings that participants retain during their job tenure, and when they leave to join another employer.

Cybersecurity is Augmented by Auto Portability

All companies that manage personal consumer data, regardless of where they are based or what industry they are part of, are right to be concerned about cybersecurity. The scope and scale of cyberattacks continue to increase around the world, as last year’s breach compromising 50 million Facebook users demonstrated.

Tax Day is Coming—Encourage Millennial Participants to Incubate Saver’s Credits

April 15 is just around the corner. While many Americans dread Tax Day, April 15 presents defined contribution plan sponsors with an opportunity to demonstrate their value as fiduciaries, and as financial wellness advocates.

How Auto Portability Serves Participants’ Best Interests - Part 2: An Enhanced Standard of Participant Care

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

Previously, in Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability.

In Part 2, I describe how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of care for participants.

5 Ways to Check if Your ARO Program Needs an Upgrade

The long-awaited Department of Labor (DOL) guidance on the legal and regulatory framework for auto portability has cleared the way for plan sponsors to further enhance and optimize their automatic rollover programs. By explicitly recognizing auto portability’s potential benefits to retirement savers, the DOL acknowledges that existing ARO programs have flaws which auto portability can fix.

The long-awaited Department of Labor (DOL) guidance on the legal and regulatory framework for auto portability has cleared the way for plan sponsors to further enhance and optimize their automatic rollover programs. By explicitly recognizing auto portability’s potential benefits to retirement savers, the DOL acknowledges that existing ARO programs have flaws which auto portability can fix.

How Auto Portability Serves Participants’ Best Interests, Part 1: Dramatically Improved Participant Outcomes

Plan sponsors considering the adoption of auto portability must determine that, by participating in the auto portability program, they are acting prudently and solely in the interests of their plan’s participants and beneficiaries.

Plan sponsors considering the adoption of auto portability must determine that, by participating in the auto portability program, they are acting prudently and solely in the interests of their plan’s participants and beneficiaries.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?