Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Auto Portability (14)

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

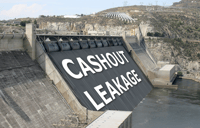

The Magnitude of the 401(k) Cashout Leakage Problem

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it. The third of a five-part series, this article addresses the magnitude of the 401(k) cashout leakage problem.

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it. The third of a five-part series, this article addresses the magnitude of the 401(k) cashout leakage problem.

The Safe-Harbor IRA: Friend or Foe?

An Important Milestone: The DOL Issues Final Prohibited Transaction Exemption for Auto Portability

On July 31st, the U.S. Department of Labor (DOL) released the final Prohibited Transaction Exemption (PTE) to Retirement Clearinghouse (RCH) for the RCH Auto Portability program, completing the regulatory framework and clearing the way for auto portability’s widespread adoption.

On July 31st, the U.S. Department of Labor (DOL) released the final Prohibited Transaction Exemption (PTE) to Retirement Clearinghouse (RCH) for the RCH Auto Portability program, completing the regulatory framework and clearing the way for auto portability’s widespread adoption.

This new development represents an important milestone on the path to auto portability, a private-sector innovation that will help prevent 401(k) cashout leakage, increase plan efficiencies and improve the prospects of a timely, comfortable and secure retirement for millions of Americans.

The Demographics of 401(k) Cashout Leakage

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

What’s Missing from the SECURE Act? A Provision to Plug Cash-Out Leakage

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019, passed by the House of Representatives on May 23, has the potential to make a positive impact on Americans’ retirement readiness. One of the bill’s key provisions involves removing restrictions on open multiple employer plans (MEPs), which would make it less costly for small businesses to offer retirement savings plans to employees.

Spotlight on Cashout Leakage: The Fundamentals

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

The first of a five-part series, this article addresses the fundamentals of cashout leakage.

How Auto Portability Serves Participants’ Best Interests: Part 5

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

Previously: In Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability. In Part 2, I described how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of participant care. In Part 3, I presented evidence that the adoption of auto portability could lead to a reduction in plan expenses. In Part 4, I addressed how auto portability could enhance 401(k) participants’ financial wellness.

In part 5, my final installment of the series, I explain how auto portability can mitigate retirement-related cybersecurity risks.

How Auto Portability Serves Participants’ Best Interests - Part 4: Auto Portability Enhances Participants' Financial Wellness

In this five-part series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this five-part series, I identify five key reasons why an auto portability program serves the best interests of plan participants. Previously:

- In Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability.

- In Part 2, I described how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of participant care.

- In Part 3, I presented evidence that the adoption of auto portability could lead to a reduction in plan expenses.

In Part 4, I address how auto portability could enhance 401(k) participants’ financial wellness.

A Plan Metric Every Sponsor Should Track: Participant-Retained Retirement Savings

When evaluating their defined contribution plans, plan sponsors understandably look at standard benchmarks such as rate of participation, average deferral percentage, and average account balance. However, given the highly mobile nature of today’s American workforce, sponsors should also consider tracking the average percentage of retirement savings that participants retain during their job tenure, and when they leave to join another employer.

LIMRA Webinar Features Michael Kreps’ Update on Auto Portability

On April 16th, as part of their Strategic Issues Webinar Series, the LIMRA Secure Retirement Institute delivered the webinar Regulatory and Legislative Trends Impacting the U.S. Retirement System. The LIMRA webinar featured presenter Michael Kreps, Principal, Groom Law Group, and was moderated by Judy Zaiken, Corporate Vice President, LIMRA.

On April 16th, as part of their Strategic Issues Webinar Series, the LIMRA Secure Retirement Institute delivered the webinar Regulatory and Legislative Trends Impacting the U.S. Retirement System. The LIMRA webinar featured presenter Michael Kreps, Principal, Groom Law Group, and was moderated by Judy Zaiken, Corporate Vice President, LIMRA.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?