Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

America's Mobile Workforce (4)

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

The New Age of DC Plan Portability

A recent survey of defined contribution (DC) plan sponsors found that interest in retaining assets for retirement is on the rise. That finding, paired with certain provisions of the SECURE Act of 2019, suggests that DC plans are on a path to becoming “decumulation vehicles” for American retirees. While these developments are encouraging, persistently high levels of cashout leakage, increasing missing participants and other factors produce understandable pessimism regarding the future of DC plans.

A recent survey of defined contribution (DC) plan sponsors found that interest in retaining assets for retirement is on the rise. That finding, paired with certain provisions of the SECURE Act of 2019, suggests that DC plans are on a path to becoming “decumulation vehicles” for American retirees. While these developments are encouraging, persistently high levels of cashout leakage, increasing missing participants and other factors produce understandable pessimism regarding the future of DC plans.

Auto Portability 2019: The Year in Review

At Retirement Clearinghouse (RCH), we’re excited about the 2020 prospects for auto portability. Before we’re too far into a new decade, we wanted to pause, take a breath and share with you some highlights from 2019, a year that’s positioned the newest automatic, default plan feature for widespread adoption.

At Retirement Clearinghouse (RCH), we’re excited about the 2020 prospects for auto portability. Before we’re too far into a new decade, we wanted to pause, take a breath and share with you some highlights from 2019, a year that’s positioned the newest automatic, default plan feature for widespread adoption.

The Magnitude of the 401(k) Cashout Leakage Problem

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it. The third of a five-part series, this article addresses the magnitude of the 401(k) cashout leakage problem.

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it. The third of a five-part series, this article addresses the magnitude of the 401(k) cashout leakage problem.

The Demographics of 401(k) Cashout Leakage

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

Spotlight on Cashout Leakage: The Fundamentals

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

Cashout leakage, a long-standing problem in America’s defined contribution system, is a silent crisis that unnecessarily robs millions of Americans of a comfortable, timely or secure retirement. Plagued by misunderstanding and neglect, it’s vitally important to understand the problem and to take decisive action to curb it.

The first of a five-part series, this article addresses the fundamentals of cashout leakage.

EBRI Webinar Examines Impact of Tenure on Retirement Savings

On April 10th, the Employee Benefit Research Institute (EBRI) featured the webinar EBriefing: Trends in Employee Tenure, showcasing the latest EBRI research examining broad employee tenure trends over time, and the impact that shorter tenure can have on retirement savings.

On April 10th, the Employee Benefit Research Institute (EBRI) featured the webinar EBriefing: Trends in Employee Tenure, showcasing the latest EBRI research examining broad employee tenure trends over time, and the impact that shorter tenure can have on retirement savings. The webinar’s presenters included Craig Copeland, Senior Research Associate, EBRI and Spencer Williams, President & CEO, Retirement Clearinghouse (RCH), and was moderated by Stacy Schaus, Founder & CEO, Schaus Group LLC.

Auto Portability is Like Bacon—It Makes Everything Better

When auto enrollment was widely adopted under the Pension Protection Act of 2006, it was a well-intentioned idea for helping Americans save more for retirement.

When auto enrollment was widely adopted under the Pension Protection Act of 2006, it was a well-intentioned idea for helping Americans save more for retirement.

But in this case, what seemed like the perfect recipe for increasing retirement savings for hardworking Americans was missing a key ingredient.

Is Your Missing-Participant Program a Ford Model T or 2018 BMW?

A primary responsibility for fiduciaries is to seek out and identify the best available solutions that enable fulfillment of their responsibilities. For plan sponsors tasked with implementing and evaluating the effectiveness of their missing participant program, this can be a difficult task, particularly given the accelerating rate of technological innovation and the virtual explosion of new sources of data available online. In today’s day and age, what is considered a state-of-the-art program today could easily become obsolete tomorrow, rendering a plan’s missing-participant program vulnerable to fiduciary liability.

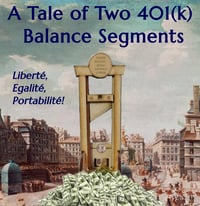

A Tale of Two 401(k) Balance Segments

It was the best of times, it was the worst of times.

It was the best of times, it was the worst of times.

For job-changing 401(k) participants with balances greater than $15,000, it was the spring of financial wellness, as the bulk of their retirement savings would remain intact. For less-aristocratic 401(k) savers with balances below $15,000, it was the winter of despair, as most of their savings would be lost on the cashout chopping block or forcibly exiled to a safe harbor IRA, where more savings would perish.

The Next Big Advancement for the 401(k)

Although the 401(k) is today the primary retirement-savings vehicle for many hardworking Americans, it can be easy to forget that the 401(k) is still a relatively new phenomenon.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?