Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

Auto Portability Helps Everybody, and Hurts Nobody

“So, whose ox are you goring with auto portability?”

“So, whose ox are you goring with auto portability?”

This is what a senior, well-respected retirement policy official asked my team at a sit-down meeting in Washington, D.C. Over the course of her long career, she had heard innumerable proposals to correct the savings shortfall in the U.S. retirement system. Many of them had a downside for at least one constituency in the retirement services universe, and she assumed that auto portability had one too.

Big Changes Coming for Small 401(k) Accounts

The pace of change in today’s world is faster than ever -- and accelerating. Consider the vast change witnessed by today’s centenarians over the course of their lives – moving from the horse-and-buggy to aviation, moon landings, the Internet and smartphones.

The pace of change in today’s world is faster than ever -- and accelerating. Consider the vast change witnessed by today’s centenarians over the course of their lives – moving from the horse-and-buggy to aviation, moon landings, the Internet and smartphones.

Incubate Small Retirement Accounts, Don’t Throw Them Away

On February 3rd, the U.S. Chamber of Commerce, the world’s largest business federation representing the interests of more than 3 million businesses, released Securing America’s Retirement, their legislative roadmap aimed at strengthening the U.S. retirement system.

On February 3rd, the U.S. Chamber of Commerce, the world’s largest business federation representing the interests of more than 3 million businesses, released Securing America’s Retirement, their legislative roadmap aimed at strengthening the U.S. retirement system.

The Chamber’s goals are admirable.

Uncashed Distribution Checks: An Ounce of Prevention is Worth a Pound of Cure

Now that we’re in the thick of flu season, we’re reminded of Ben Franklin’s famous axiom: “an ounce of prevention is worth a pound of cure.” A yearly flu shot is perhaps the best example of an effective, preventative action you can take to minimize your odds of catching the flu, and keep you breathing more easily than those who haven’t.

Now that we’re in the thick of flu season, we’re reminded of Ben Franklin’s famous axiom: “an ounce of prevention is worth a pound of cure.” A yearly flu shot is perhaps the best example of an effective, preventative action you can take to minimize your odds of catching the flu, and keep you breathing more easily than those who haven’t.

One Small Improvement for 401(k) Plans, One Giant Leap for Retirement Readiness

Baby boomers will never forget Neil Armstrong’s famous quote in 1969, after becoming the first human being to set foot on the moon:

Baby boomers will never forget Neil Armstrong’s famous quote in 1969, after becoming the first human being to set foot on the moon:

“That’s one small step for (a) man, one giant leap for mankind.”

Today, America faces a different, more down-to-earth challenge: delivering our citizens a comfortable and timely retirement. And similar to the moon landing – a ‘small step’ in the right direction can have a huge impact on the course of our lives.

Auto Portability Simulation (APS)

This video presentation is designed to give the viewer a basic understanding of the Auto Portability Simulation (APS), which models the operation and benefits of Auto Portability.

This video presentation is designed to give the viewer a basic understanding of the Auto Portability Simulation (APS), which models the operation and benefits of Auto Portability.

How to Remove 'Friction' from the 401(k) System

In consolidated testimony before the ERISA Advisory Council on the topic of Participant Plan Transfers and Account Consolidation for the Advancement of Lifetime Plan Participation, EBRI’s Craig Copeland and Retirement Clearinghouse’s Tom Johnson presented “Auto Portability Research & Simulation: Automating Plan-to-Plan Transfers for Small Accounts” – providing the Council with the latest information & research on Auto Portability, as well as describing the present state of plan-to-plan transfers (“roll-ins”).

In consolidated testimony before the ERISA Advisory Council on the topic of Participant Plan Transfers and Account Consolidation for the Advancement of Lifetime Plan Participation, EBRI’s Craig Copeland and Retirement Clearinghouse’s Tom Johnson presented “Auto Portability Research & Simulation: Automating Plan-to-Plan Transfers for Small Accounts” – providing the Council with the latest information & research on Auto Portability, as well as describing the present state of plan-to-plan transfers (“roll-ins”).

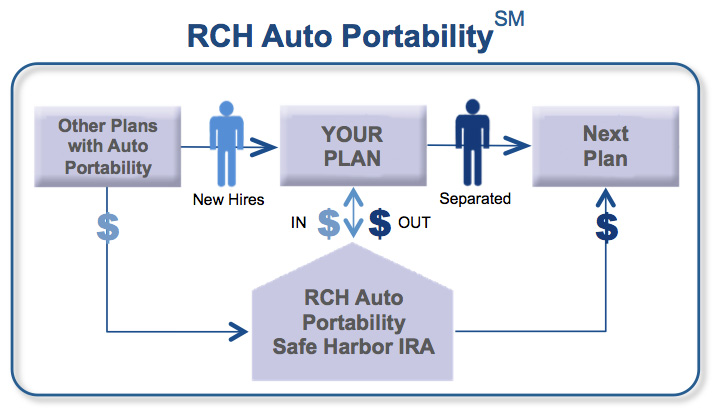

The ABCs of Auto Portability

What is Auto Portability? This video presentation is designed to give the viewer a basic understanding of Auto Portability.

What is Auto Portability? This video presentation is designed to give the viewer a basic understanding of Auto Portability.

LIMRA's Secure Retirement Institute Features Auto Portability Research

This January, LIMRA’s Secure Retirement Institute is promoting their research on Auto Portability, which contains an impressive array of information.

This January, LIMRA’s Secure Retirement Institute is promoting their research on Auto Portability, which contains an impressive array of information.

This Year, Resolve to Debunk Two Common Retirement-Saving Myths for Participants

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?