When it comes to the 401(k) plan feature known as automatic enrollment, most industry observers seem to agree that it’s a good thing. In a world of scarce resources, you can never have too much of a good thing, right?

When it comes to the 401(k) plan feature known as automatic enrollment, most industry observers seem to agree that it’s a good thing. In a world of scarce resources, you can never have too much of a good thing, right?

Unfortunately, recent industry data suggests that adoption of automatic enrollment has begun to lose steam, and has not yet gained a firm footing in certain sectors.

Why? Where does the resistance to automatic enrollment come from, and what can be done to re-ignite the next era of its adoption?

Automatic Enrollment: Large Plans Lead the Way

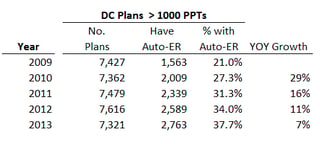

As the table below indicates, automatic enrollment has experienced healthy growth in defined contribution plans with greater than 1,000 participants.

Table 1: Defined Contribution Plan Auto Enrollment Take-Up (Plans with >1,000 Participants)

Source: Form 5500 Data Sets, United States Department of Labor

As the numbers above indicate, large plans experienced a surge in automatic enrollment adoption during these years. However, the growth rate of initial adoption began to wane as early as 2011, reaching single digits in 2013.

Resistance to Automatic Enrollment

The Department of Labor and the Internal Revenue Service, in their 2013 publication Automatic Enrollment 401(k) Plans for Small Businesses, states that “approximately 30 percent of eligible workers do not participate in their employer’s 401(k) type plan. Studies suggest that automatic enrollment plans could reduce this rate to less than 15 percent, significantly increasing retirement savings.”

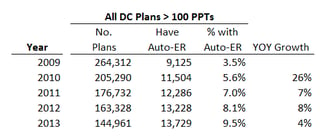

Perhaps the reason that the DOL and the IRS focused their attention on small businesses can be found through further analysis of Form 5500 data for the same period. When the analysis is extended to include all plans with greater than 100 participants, the result is less impressive. As smaller plans are included in the analysis, the rate of adoption declines dramatically.

Table 2: Defined Contribution Plan Auto Enrollment Take-Up (Plans with >100 Participants)

Source: Form 5500 Data Sets, United States Department of Labor

Industry Differences

High rates of employee turnover seem to be a major impediment to automatic enrollment adoption.

In industries where labor turnover is high, we see much higher levels of separated participants for automatic enrollment adopters, along with much lower average balances, vs. non-adopters.

For example, in 2013 the Food & Beverage Stores industry had:

- 109 plans with almost 1.2 million participants.

- Of those 109 plans, only 26 (24%) had an automatic enrollment feature, whereas 83 (76%) did not.

- Average balances were 10.2% lower in the automatic enrollment group, compared to the group without an automatic enrollment feature.

- Almost 27% of the automatic enrollment group’s participants were separated, vs. 14% in the non-automatic enrollment group.

Small Balance, Stranded Accounts

In an earlier analysis, we demonstrated that automatic enrollment has resulted in a proliferation of small accounts, which lowers plan average balances. This gap in average balances between adopters and non-adopters was striking, varying by 7%, across all plans. In follow-on analysis, we further demonstrated that automatic enrollment was linked to higher levels of separated participants in-plan.

Finally, we pointed out the increase in penalties for plan sponsors not properly maintaining current addresses for separated participants, further increasing potential costs associated with separated participants.

The Next Great Era of Automatic Enrollment

Our data indicates that the growth of automatic enrollment has been stymied by the problems associated with an explosion of small-balance, separated participants – particularly in small businesses and in industries with high labor turnover rates.

Ironically, the solution to these problems can be found in another, emerging “automatic” feature: auto portability. Auto portability is the routine, standardized and automatic movement of an inactive participant’s small balance retirement account (less than $5,000) from a former employer’s retirement plan to an active account at a new employer’s retirement plan, when a participant changes job.

Auto portability reduces cash outs and results in higher levels of plan-to-plan consolidation.

By overcoming the issues that provide resistance to automatic enrollment, adoption of auto portability could very well provide a new boost to auto enrollment adoption, resulting in higher levels of plan participation and generating greater levels of savings in the 401(k) retirement system.