The recent U.S. Presidential election brought renewed focus upon large infrastructure projects: massive, capital-intensive efforts required to rebuild America’s roads, bridges, railways and airports. Desperately needed, these projects could cost taxpayers hundreds of billions, perhaps even trillions of dollars.

The recent U.S. Presidential election brought renewed focus upon large infrastructure projects: massive, capital-intensive efforts required to rebuild America’s roads, bridges, railways and airports. Desperately needed, these projects could cost taxpayers hundreds of billions, perhaps even trillions of dollars.

However, there’s another vitally-needed, national infrastructure project that has negligible cost – but could generate trillions in savings, placed directly into the pockets of hard-working Americans. Finally, it can be delivered by the private sector, at no cost to American taxpayers.

Sound too good to be true? It’s not.

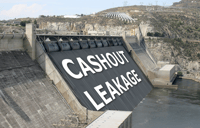

Reducing Cashout Leakage

Retirement plan “cashout leakage” may not be a term you’re familiar with. Characterized by the premature withdrawal of savings from qualified retirement plans prior to normal retirement age, cashout leakage is tragic, depriving millions of hardworking Americans of a comfortable or timely retirement. The vast majority of cashout leakage occurs at job change, when as much as 60% of qualified plan participants simply take the path of least resistance, electing to prematurely distribute their retirement savings. The sad part is, most participants don’t even need the money. According to a Boston Research Technologies study on the mobile workforce distribution decisions, only 1/3 of participants that cashed out a retirement plan indicated they did so due to an emergency.

In 2012, the Employee Benefit Research Institute (EBRI) estimated that a 50% reduction in cashout leakage would add $1.3 trillion to our retirement savings, over a 10-year period.

If you’re jaded by large numbers, $1.3 trillion is:

- Greater than the gross domestic product (GDP) of all but 11 of the world’s economies.

- Slightly less than the GDP of South Korea ($1.4 Trillion), but greater than Russia ($1.26 trillion) and Australia ($1.25 trillion).

- Roughly equal to the combined GDP of Iran, Saudi Arabia and the UAE.

The benefits of reducing cashout leakage are impressive, but become truly mind-boggling as the timeline is extended over a generation of savers. A straight-line extension of EBRI’s original estimates over a 40-year period increases the savings to a whopping $18.9 trillion, which is larger than the present GDP of the United States ($18.5 trillion)!

Implementing a Cashout Leakage Reduction Initiative

With so much retirement income at risk, one would think that reducing cashout leakage would be a massive undertaking, but it’s not.

At least half of cashout leakage Is easily-preventable through private-sector programs that move retirement savings forward, as participants change jobs. As studies of America’s mobile workforce and best practices have shown, cashout leakage can easily be reduced by 50%, simply by making portability the easiest choice for qualified plan participants.

This is exactly what The Bipartisan Policy Center (BPC) recommended in their recent report “Securing Our Financial Future.” During the Bipartisan Policy Center’s discussion on June 9, 2016 in Washington, D.C., panel participants highlighted the Commission’s recommendation to establish a nationwide private-sector retirement security clearinghouse to help participants seamlessly move retirement savings account balances from plan to plan as they change jobs, and to consolidate multiple retirement accounts in a participant’s current-employer plan.

Taking the BPC’s lead, initiatives such as Auto Portability are already making progress. Addressing only sub-$5,000 balances that are subject to mandatory distributions, a discrete simulation model has demonstrated that Auto Portability could add $115 billion to Americans’ retirement savings over the next 40 years.

In 2017, as DC policymakers contemplate the many infrastructure initiatives competing for scarce resources, remember that the Cashout Leakage Reduction Initiative may be the most compelling project of all.

This article was also featured in BenefitsPro.