Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

Broadcast Retirement Network Features Segment on ‘Small Account Problem’

On Wednesday, 11/4/20 the Broadcast Retirement Network’s Jeff Snyder interviewed Retirement Clearinghouse (RCH) President & CEO Spencer Williams and Alight Solutions’ Vice President & Head of Research Rob Austin to address the 401(k) system’s small account problem – where high levels of cashout leakage in small balance segments perennially robs millions of participants of a timely or comfortable retirement.

On Wednesday, 11/4/20 the Broadcast Retirement Network’s Jeff Snyder interviewed Retirement Clearinghouse (RCH) President & CEO Spencer Williams and Alight Solutions’ Vice President & Head of Research Rob Austin to address the 401(k) system’s small account problem – where high levels of cashout leakage in small balance segments perennially robs millions of participants of a timely or comfortable retirement.

If Timothy Leary Were a 401(k) Plan Sponsor

In the 1960’s, counter-culture guru Timothy Leary urged a generation to “turn on, tune in and drop out.” It’s probably a good thing that I didn’t take his advice….at least not the “drop out” part!

In the 1960’s, counter-culture guru Timothy Leary urged a generation to “turn on, tune in and drop out.” It’s probably a good thing that I didn’t take his advice….at least not the “drop out” part!

The Explosion of Small-Balance IRAs

Based on solid research, we’ve long known that typical automatic rollover IRAs result in high levels of cashout leakage. We’ve also suspected that they’ve contributed to an explosion of small-balance IRAs.

Based on solid research, we’ve long known that typical automatic rollover IRAs result in high levels of cashout leakage. We’ve also suspected that they’ve contributed to an explosion of small-balance IRAs.

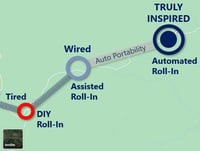

From Tired to Inspired: A Roadmap for 401(k) Roll-Ins

As I wrote in a previous article, 401(k) automated portability is an idea whose time has come. To achieve that vision, how will we get from the present state to full automation of the plan-to-plan roll-in process?

As I wrote in a previous article, 401(k) automated portability is an idea whose time has come. To achieve that vision, how will we get from the present state to full automation of the plan-to-plan roll-in process?

This article, as well as the video below, offers readers a roadmap for the progression from ‘tired’ to ‘wired’ and finally, to the ‘inspired’ state that will eventually characterize 401(k) roll-ins.

Every Dollar Counts in Today’s Zero-Interest-Rate Environment

It’s no secret that interest rates have been at historically low levels for quite some time, but the recent announcement by Federal Reserve Chairman Jerome Powell indicates that rates will stay near zero for the foreseeable future. Chairman Powell stated in his address last month that the Fed would tolerate above-2% inflation instead of attempting to preemptively control inflation by raising interest rates.

It’s no secret that interest rates have been at historically low levels for quite some time, but the recent announcement by Federal Reserve Chairman Jerome Powell indicates that rates will stay near zero for the foreseeable future. Chairman Powell stated in his address last month that the Fed would tolerate above-2% inflation instead of attempting to preemptively control inflation by raising interest rates.

Automated 401(k) Portability: An Idea Whose Time Has Come

French author and poet Victor Hugo observed: “nothing is more powerful than an idea whose time has come.”

French author and poet Victor Hugo observed: “nothing is more powerful than an idea whose time has come.”

In theory at least, plan-to-plan portability has always been a feature of our 401(k) system. In practice, it’s been completely impractical for all but a hardy few. The idea of automating 401(k) portability was the holy grail, a ‘moonshot’ generally believed to be impossible…until now.

401(k) Plan Terminations Could Produce New Wave of Cashout Leakage

During the COVID-19 crisis, massive job losses combined with economic hardship and relaxed restrictions on withdrawals have created the conditions for a perfect storm of 401(k) cashout leakage. Unfortunately, this storm may soon gain more strength, when a surge in end-of-year 401(k) plan terminations could trigger a new flood of cashouts, as participants are forced to leave their former employers’ plans.

During the COVID-19 crisis, massive job losses combined with economic hardship and relaxed restrictions on withdrawals have created the conditions for a perfect storm of 401(k) cashout leakage. Unfortunately, this storm may soon gain more strength, when a surge in end-of-year 401(k) plan terminations could trigger a new flood of cashouts, as participants are forced to leave their former employers’ plans.

‘Sudden Money’ and Preserving 401(k) Savings Don’t Mix

Researchers realize that long-term retirement planning is not a natural act for most 401(k) plan participants. Consequently, important 401(k) plan features have evolved (ex. – auto enrollment, auto escalation, QDIA funds, etc.) to overcome the mis-match and to promote saving for retirement. Many of these features work spectacularly well – but only for as long as participants are actively participating in that plan.

Researchers realize that long-term retirement planning is not a natural act for most 401(k) plan participants. Consequently, important 401(k) plan features have evolved (ex. – auto enrollment, auto escalation, QDIA funds, etc.) to overcome the mis-match and to promote saving for retirement. Many of these features work spectacularly well – but only for as long as participants are actively participating in that plan.

The Tragicomedy of Cashout Leakage

I often write about the phenomenon of cashout leakage, which occurs when participants change jobs and prematurely withdraw their retirement savings, prior to normal retirement age.

I often write about the phenomenon of cashout leakage, which occurs when participants change jobs and prematurely withdraw their retirement savings, prior to normal retirement age.

How to Mitigate COVID-19’s Potentially Catastrophic Impact on Americans’ Retirement Readiness

It’s bad enough that more than 50 million Americans have filed claims for unemployment benefits since the start of the COVID-19 pandemic and lockdown. But in addition to the disruption, financial hardship, and uncertainty that unemployed Americans (and their families) are experiencing right now, this crisis also threatens their financial security during retirement.

It’s bad enough that more than 50 million Americans have filed claims for unemployment benefits since the start of the COVID-19 pandemic and lockdown. But in addition to the disruption, financial hardship, and uncertainty that unemployed Americans (and their families) are experiencing right now, this crisis also threatens their financial security during retirement.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?