Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Auto Portability (18)

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

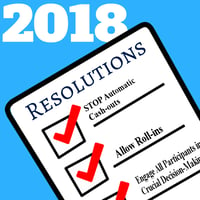

The Most Urgent New Year’s Resolutions for Plan Sponsors

How are you hoping to improve yourself in 2018?

How are you hoping to improve yourself in 2018?

The most common New Year’s resolutions usually have to do with personal appearance, health, or behavior—losing weight, exercising more, dieting, quitting smoking, etc. Popular polls indicate that many of us are after a slimmer, fitter body for ourselves after each New Year’s Day.

Similarly, defined contribution plan sponsors are likely thinking about how they can make their plans more attractive and streamlined in 2018.

The Best Blueprint for Improving Retirement Security

Much has been written in this column and elsewhere about the benefits that auto portability, and seamless plan-to-plan portability in general, can provide to millions of retirement-savers across America. As any entrepreneur can testify, it is challenging to initiate a major innovation, and then persevere through all the twists and turns along the road to widespread adoption. Fortunately for everyday Americans saving for retirement, there is already an established blueprint in place for launching a nationwide, private-sector retirement clearinghouse that will enable auto portability.

Much has been written in this column and elsewhere about the benefits that auto portability, and seamless plan-to-plan portability in general, can provide to millions of retirement-savers across America. As any entrepreneur can testify, it is challenging to initiate a major innovation, and then persevere through all the twists and turns along the road to widespread adoption. Fortunately for everyday Americans saving for retirement, there is already an established blueprint in place for launching a nationwide, private-sector retirement clearinghouse that will enable auto portability.

The Results Are In: Auto Portability is a Winner!

On November 7th, Retirement Clearinghouse (RCH) issued a press release announcing the results of the first-ever implementation of auto portability, as evaluated by Boston Research Technologies (BRT)’s Warren Cormier in his just-published white paper “Making the Right Choice the Easiest Choice: Eliminating Friction and Leaks in America’s Defined Contribution System.”

On November 7th, Retirement Clearinghouse (RCH) issued a press release announcing the results of the first-ever implementation of auto portability, as evaluated by Boston Research Technologies (BRT)’s Warren Cormier in his just-published white paper “Making the Right Choice the Easiest Choice: Eliminating Friction and Leaks in America’s Defined Contribution System.”

How to Contain the Damage from the Small-Account Explosion

Much has been written about the proliferation of small accounts in our nation’s retirement system, and the problems that this explosion has created. A primary solution to the small-account quandary that I have frequently advocated in this column is auto portability.

Much has been written about the proliferation of small accounts in our nation’s retirement system, and the problems that this explosion has created. A primary solution to the small-account quandary that I have frequently advocated in this column is auto portability.

In Search Of: Guidance for Locating Missing Participants

Two weeks ago, I authored an article applauding the American Benefits Council for their October 2nd, 2017 letter to the Department of Labor (DOL), which clearly identified the root causes of missing participants: a highly-mobile workforce and a lack of retirement savings portability. Extending the Council’s insight, I maintained that what’s really “missing” in our defined contribution system are initiatives that move retirement savings forward when participants change jobs, such as auto portability. When implemented, these initiatives could serve to dramatically decrease the overall incidence of missing participants.

Two weeks ago, I authored an article applauding the American Benefits Council for their October 2nd, 2017 letter to the Department of Labor (DOL), which clearly identified the root causes of missing participants: a highly-mobile workforce and a lack of retirement savings portability. Extending the Council’s insight, I maintained that what’s really “missing” in our defined contribution system are initiatives that move retirement savings forward when participants change jobs, such as auto portability. When implemented, these initiatives could serve to dramatically decrease the overall incidence of missing participants.

Bringing Clarity to the Murky Problem of Missing Participants

On October 2nd, 2017, the American Benefits Council delivered a letter to the Department of Labor (DoL), urging the DoL to act on the problem of unresponsive or missing participants, an issue that has proven to be a significant point-of-pain for plan sponsors.

On October 2nd, 2017, the American Benefits Council delivered a letter to the Department of Labor (DoL), urging the DoL to act on the problem of unresponsive or missing participants, an issue that has proven to be a significant point-of-pain for plan sponsors.

‘May Day, May Day’: Locate your plan’s lost & missing participants before it’s too late

The recent hacking of Equifax, which potentially compromised the security of sensitive information for 143 million Americans, doesn’t just reinforce the importance of cybersecurity. This cyberattack also makes a compelling case for the widespread adoption of auto portability.

The recent hacking of Equifax, which potentially compromised the security of sensitive information for 143 million Americans, doesn’t just reinforce the importance of cybersecurity. This cyberattack also makes a compelling case for the widespread adoption of auto portability.

Why Consolidation Should Top the List of Initiatives for Plan Sponsors in 2018

Today, it’s commonly-accepted practice for retirement plan sponsors to focus on three major initiatives to promote retirement adequacy: participation, saving and diversification.

Today, it’s commonly-accepted practice for retirement plan sponsors to focus on three major initiatives to promote retirement adequacy: participation, saving and diversification.

While these three initiatives are proven, an emerging best practice is for plan sponsors to expand this list, incorporating consolidation, where plan participants are encouraged to consolidate balances from former employers’ plans, using their current-employer’s plan to manage their retirement savings.

The Explosion of Small 401(k) Accounts

It’s generally accepted that the small-balance accounts of terminated 401(k) plan participants have been a problem for plan sponsors, resulting in increased plan costs, fiduciary risk and other ancillary problems, such as missing participants and uncashed distribution checks.

It’s generally accepted that the small-balance accounts of terminated 401(k) plan participants have been a problem for plan sponsors, resulting in increased plan costs, fiduciary risk and other ancillary problems, such as missing participants and uncashed distribution checks.

Now, based on new information from EBRI and other sources, we’re learning that small accounts are a large and growing problem for active participants as well.

Don’t Wait Until It’s Too Late: Prepare Now for Year-End 401(k) Plan Terminations

As we enter the 4th quarter of 2017, many plan sponsors (as well as their advisors) will face the prospect of terminating a 401(k) plan. For most, this will be the first -- and only -- time that they’ll undertake this important initiative, typically without the benefit of prior experience.

As we enter the 4th quarter of 2017, many plan sponsors (as well as their advisors) will face the prospect of terminating a 401(k) plan. For most, this will be the first -- and only -- time that they’ll undertake this important initiative, typically without the benefit of prior experience.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?