Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

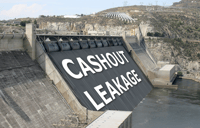

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

401k Consolidation (12)

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

Preventing retirement plan leakage: An infrastructure project that saves trillions

The recent U.S. Presidential election brought renewed focus upon large infrastructure projects: massive, capital-intensive efforts required to rebuild America’s roads, bridges, railways and airports. Desperately needed, these projects could cost taxpayers hundreds of billions, perhaps even trillions of dollars.

The recent U.S. Presidential election brought renewed focus upon large infrastructure projects: massive, capital-intensive efforts required to rebuild America’s roads, bridges, railways and airports. Desperately needed, these projects could cost taxpayers hundreds of billions, perhaps even trillions of dollars.

What is Synthetic Tenure, and Why is it Important?

It is intuitive to observe that the easiest way for a plan participant to achieve lifetime participation in the U.S. retirement system is to work for the same employer for 40 years or more. But in today’s highly mobile workforce, that rarely happens. According to the Employee Benefit Research Institute (EBRI), the average American will change jobs more than seven times during a 40-year working life, indicating that a participant’s average tenure with each employer will be a little over five years. So what can be done to help the vast majority of participants that simply won’t work for one employer for their entire careers?

It is intuitive to observe that the easiest way for a plan participant to achieve lifetime participation in the U.S. retirement system is to work for the same employer for 40 years or more. But in today’s highly mobile workforce, that rarely happens. According to the Employee Benefit Research Institute (EBRI), the average American will change jobs more than seven times during a 40-year working life, indicating that a participant’s average tenure with each employer will be a little over five years. So what can be done to help the vast majority of participants that simply won’t work for one employer for their entire careers?

A Roll-In in Time Saves Far More Than Nine

In his latest MarketWatch RetireMentors column, RCH CEO Spencer Williams modifies the familiar proverb “a stitch in time saves nine” for the benefit of 401(k) savers who have multiple retirement savings accounts. A roll-in becomes the equivalent of the stitch, saving participants considerable time and money as they change jobs.

In his latest MarketWatch RetireMentors column, RCH CEO Spencer Williams modifies the familiar proverb “a stitch in time saves nine” for the benefit of 401(k) savers who have multiple retirement savings accounts. A roll-in becomes the equivalent of the stitch, saving participants considerable time and money as they change jobs.

Why our retirement system is broken

A Different ‘Save’ to Consider During ‘National Save for Retirement Week’

By Neal Ringquist and Tom Hawkins

By Neal Ringquist and Tom Hawkins

As we prepare to observe National Save for Retirement Week (also known as “National Retirement Security Week”), scheduled for October 16-22, it’s a great opportunity to remember why we, as individuals, need to save for our retirement. But the sobering reality is that we are all being called upon to save retirement itself—by rescuing a retirement system that doesn’t work for millions of hardworking Americans.

How You Should Observe ‘National Save for Retirement Week’

In his most recent article in MarketWatch, RCH’s Spencer Williams notes the upcoming ‘National Save for Retirement Week’ event, and employs some clever word-association that has readers re-thinking the meaning of the word “save.”

In his most recent article in MarketWatch, RCH’s Spencer Williams notes the upcoming ‘National Save for Retirement Week’ event, and employs some clever word-association that has readers re-thinking the meaning of the word “save.”

The One Solution Everyone in DC Agrees Upon: We Need Consolidation

This summer, there’s one topic that everyone in Washington, D.C. seems to agree upon: the importance of consolidation in protecting Americans’ retirement security.

This summer, there’s one topic that everyone in Washington, D.C. seems to agree upon: the importance of consolidation in protecting Americans’ retirement security.

Why helping employees review 401(k)s isn’t a mission impossible

Consolidation: Make the Smart Decision the Easiest Decision

“Make the smart decision the easiest decision” seems like an obvious goal for plan sponsors when designing participant-directed retirement plans, and it’s certainly driven the rapid adoption of the autos—auto enrollment, auto deferral escalation, and auto investment options, such as target-date funds and managed accounts.

“Make the smart decision the easiest decision” seems like an obvious goal for plan sponsors when designing participant-directed retirement plans, and it’s certainly driven the rapid adoption of the autos—auto enrollment, auto deferral escalation, and auto investment options, such as target-date funds and managed accounts.

Making Your Day, Re-Visited: When Retirement Savers’ Luck Runs Out

In his most recent article in MarketWatch, "Are you still feeling luck, 401(k) saver?" RCH’s Spencer Williams reprises last year’s 7/10/15 article where he channeled Clint Eastwood’s iconic movie hero “Dirty Harry” Callahan. Just like the movie villains whose luck ran out at the hands of Dirty Harry, retirement savers who strand their 401(k) accounts must run a gauntlet of decidedly unlucky outcomes – including involuntary cashouts, automatic rollovers and savings-depleting fees.

In his most recent article in MarketWatch, "Are you still feeling luck, 401(k) saver?" RCH’s Spencer Williams reprises last year’s 7/10/15 article where he channeled Clint Eastwood’s iconic movie hero “Dirty Harry” Callahan. Just like the movie villains whose luck ran out at the hands of Dirty Harry, retirement savers who strand their 401(k) accounts must run a gauntlet of decidedly unlucky outcomes – including involuntary cashouts, automatic rollovers and savings-depleting fees.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?