Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Managed Portability (3)

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

Regulators and Policy Advocates Focus on Retirement Savings Portability

Research has conclusively demonstrated that retirement savings portability dramatically reduces 401(k) cashout leakage, preserves retirement savings and reduces the incidence of missing participants. With that in mind, it’s not surprising that recent retirement public policy activities are increasingly focused on various aspects of portability.

Research has conclusively demonstrated that retirement savings portability dramatically reduces 401(k) cashout leakage, preserves retirement savings and reduces the incidence of missing participants. With that in mind, it’s not surprising that recent retirement public policy activities are increasingly focused on various aspects of portability.

The Missing Piece in 401(k) Retirement Income: Consolidation

As Baby Boomers begin to retire in record numbers, they’re shifting their attention from saving for retirement to the process of decumulation, or converting their 401(k) savings into retirement income.

For many Boomers, their current-employer’s 401(k) plan wants to come to the rescue, offering them a dizzying array of retirement income solutions. Unfortunately, as these solutions begin to encounter reality, Boomers are finding that one simple, yet critical element is missing that prevents them from working as intended – the consolidation of their retirement savings.

401(k) Consolidation: What Every Plan Sponsor Should Know

Plan sponsors intuitively know that an explosion of small-balance 401(k) accounts held by terminated participants can create problems. Unfortunately, few sponsors are clear on the factors that give rise to small accounts, and fewer still understand how they can utilize consolidation programs to solve the problem.

Understanding and Solving the Problem of Women’s 401(k) Cashout Leakage

On May 22nd, at a Women’s Institute for a Secure Retirement (WISER) roundtable addressing strategies, choices and decisions for women’s retirement income, important new data was presented that highlights the challenges faced by women in preserving their 401(k) savings when changing jobs – particularly for women with balances less than $5,000.

On May 22nd, at a Women’s Institute for a Secure Retirement (WISER) roundtable addressing strategies, choices and decisions for women’s retirement income, important new data was presented that highlights the challenges faced by women in preserving their 401(k) savings when changing jobs – particularly for women with balances less than $5,000.

Missing Participants: An Ounce of Prevention Equals a Pound of Cure

When Ben Franklin coined the adage “an ounce of prevention is worth a pound of cure” he wasn’t considering the problem of missing participants, but 401(k) plan sponsors would be wise to heed Ben’s sage advice.

When Ben Franklin coined the adage “an ounce of prevention is worth a pound of cure” he wasn’t considering the problem of missing participants, but 401(k) plan sponsors would be wise to heed Ben’s sage advice.

Today, plan sponsors face an explosion of missing participants, driven by the ongoing adoption of auto enrollment and increasing workforce mobility. Their problems are further compounded by the administrative burden required to locate them, combined with a regulatory minefield that offers little guidance and is prone to taking inconsistent enforcement actions.

America’s Modern Throwaway – 401(k) Retirement Savings

Following World War II, America saw the rise of a “throwaway” society – consuming, squandering and discarding vast quantities of national resources. Gradually, an awakening occurred as we realized that conservation was a more-sustainable path. Recycling models emerged, and once fully-adopted, they became deeply-ingrained in our psyches and formed a pillar of corporate social responsibility.

Following World War II, America saw the rise of a “throwaway” society – consuming, squandering and discarding vast quantities of national resources. Gradually, an awakening occurred as we realized that conservation was a more-sustainable path. Recycling models emerged, and once fully-adopted, they became deeply-ingrained in our psyches and formed a pillar of corporate social responsibility.

Are you all-in on roll-in? Encourage new hires to rollover old 401(k) balances into your plan

Over the past six years, there’s been a steady drumbeat pointing the way to increased portability and in-plan consolidation (“roll-ins”) as the next big strategic focus for defined contribution plans.

While this path may soon lead to the widespread adoption of auto portability, a process that automatically rolls in small balances into a participant's new-employer plan, many plan sponsors are already embracing programs that support roll-ins for all participants, regardless of balance size.

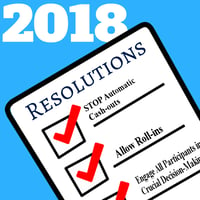

The Most Urgent New Year’s Resolutions for Plan Sponsors

How are you hoping to improve yourself in 2018?

How are you hoping to improve yourself in 2018?

The most common New Year’s resolutions usually have to do with personal appearance, health, or behavior—losing weight, exercising more, dieting, quitting smoking, etc. Popular polls indicate that many of us are after a slimmer, fitter body for ourselves after each New Year’s Day.

Similarly, defined contribution plan sponsors are likely thinking about how they can make their plans more attractive and streamlined in 2018.

How to Remove 'Friction' from the 401(k) System

In consolidated testimony before the ERISA Advisory Council on the topic of Participant Plan Transfers and Account Consolidation for the Advancement of Lifetime Plan Participation, EBRI’s Craig Copeland and Retirement Clearinghouse’s Tom Johnson presented “Auto Portability Research & Simulation: Automating Plan-to-Plan Transfers for Small Accounts” – providing the Council with the latest information & research on Auto Portability, as well as describing the present state of plan-to-plan transfers (“roll-ins”).

In consolidated testimony before the ERISA Advisory Council on the topic of Participant Plan Transfers and Account Consolidation for the Advancement of Lifetime Plan Participation, EBRI’s Craig Copeland and Retirement Clearinghouse’s Tom Johnson presented “Auto Portability Research & Simulation: Automating Plan-to-Plan Transfers for Small Accounts” – providing the Council with the latest information & research on Auto Portability, as well as describing the present state of plan-to-plan transfers (“roll-ins”).

The ABCs of Auto Portability

What is Auto Portability? This video presentation is designed to give the viewer a basic understanding of Auto Portability.

What is Auto Portability? This video presentation is designed to give the viewer a basic understanding of Auto Portability.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?