Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

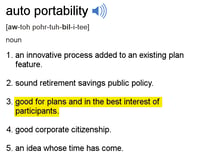

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Auto Portability Simulation

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

Six Steps to a Strong Missing Participant Policy

Missing participants, defined as individuals who have become disconnected from their retirement savings – often through their own inaction – are a significant challenge that has long plagued defined contribution plans. Unfortunately, the responsibility for locating these persons falls squarely on the shoulders of plan sponsors.

Missing participants, defined as individuals who have become disconnected from their retirement savings – often through their own inaction – are a significant challenge that has long plagued defined contribution plans. Unfortunately, the responsibility for locating these persons falls squarely on the shoulders of plan sponsors.

A More-Enlightened Approach to Uncashed Distribution Checks

No retirement plan sponsor likes the idea of dealing with uncashed distribution checks, nor do they wish to draw unwanted regulatory attention or to become embroiled in costly litigation because of their uncashed check policies.

No retirement plan sponsor likes the idea of dealing with uncashed distribution checks, nor do they wish to draw unwanted regulatory attention or to become embroiled in costly litigation because of their uncashed check policies.

Unfortunately, many plan sponsors place themselves in precisely that spot, becoming unnecessarily over-burdened with unresolved uncashed checks, while inviting unwanted regulatory scrutiny and/or legal challenges by embracing flawed uncashed check policies.

A more-enlightened approach to managing the problem of uncashed checks seeks to minimize their numbers, while simultaneously steering clear of the “red flags” that could land them in hot water.

Four Retirement Initiatives Vital to Closing the Racial Wealth Gap

Policymakers and stakeholders in America’s defined contribution system have made important progress in advancing initiatives that could help to close the large racial wealth gap. While much of the groundwork has been laid, it will ultimately fall to retirement plan sponsors to make the difference by supporting four key retirement initiatives that will generate increased wealth and enhance retirement security for millions of America’s minority workers.

Policymakers and stakeholders in America’s defined contribution system have made important progress in advancing initiatives that could help to close the large racial wealth gap. While much of the groundwork has been laid, it will ultimately fall to retirement plan sponsors to make the difference by supporting four key retirement initiatives that will generate increased wealth and enhance retirement security for millions of America’s minority workers.

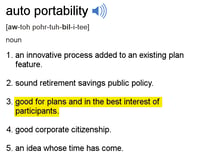

Four Key Findings from the New Auto Portability Simulation

On the heels of the 11/7/23 announcement by the Portability Services Network that the industry-led consortium has launched its digital auto portability solution powered by Retirement Clearinghouse (RCH), RCH has made available the results from a new version of their Auto Portability Simulation (APS), a discrete event simulation that models the adoption of auto portability within America’s defined contribution system, over a 40-year period.

On the heels of the 11/7/23 announcement by the Portability Services Network that the industry-led consortium has launched its digital auto portability solution powered by Retirement Clearinghouse (RCH), RCH has made available the results from a new version of their Auto Portability Simulation (APS), a discrete event simulation that models the adoption of auto portability within America’s defined contribution system, over a 40-year period.

On Filling the Leaky 401(k) Bucket

In general, legislation that gets more Americans saving for retirement is good. But if a great many of those incremental savers would likely cash out their savings immediately following a job change, then the public policy benefits might fall a bit short, no?

In general, legislation that gets more Americans saving for retirement is good. But if a great many of those incremental savers would likely cash out their savings immediately following a job change, then the public policy benefits might fall a bit short, no?

Auto Portability 2019: The Year in Review

At Retirement Clearinghouse (RCH), we’re excited about the 2020 prospects for auto portability. Before we’re too far into a new decade, we wanted to pause, take a breath and share with you some highlights from 2019, a year that’s positioned the newest automatic, default plan feature for widespread adoption.

At Retirement Clearinghouse (RCH), we’re excited about the 2020 prospects for auto portability. Before we’re too far into a new decade, we wanted to pause, take a breath and share with you some highlights from 2019, a year that’s positioned the newest automatic, default plan feature for widespread adoption.

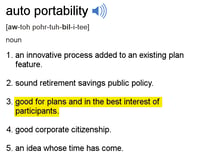

How Auto Portability Serves Participants’ Best Interests - Part 3: Auto Portability Could Lower Plan Expenses

In this five-part series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this five-part series, I identify five key reasons why an auto portability program serves the best interests of plan participants. Previously:

- In Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability.

- In Part 2, I described how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of participant care.

In Part 3, I present evidence that the adoption of auto portability could lead to a reduction in plan expenses.

How Auto Portability Serves Participants’ Best Interests - Part 2: An Enhanced Standard of Participant Care

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

In this series, I identify five key reasons why an auto portability program serves the best interests of plan participants.

Previously, in Part 1, I examined the dramatically improved participant outcomes that will result from a program of auto portability.

In Part 2, I describe how auto portability, by enhancing and extending automatic rollover programs, represents an enhanced standard of care for participants.

How Auto Portability Serves Participants’ Best Interests, Part 1: Dramatically Improved Participant Outcomes

Plan sponsors considering the adoption of auto portability must determine that, by participating in the auto portability program, they are acting prudently and solely in the interests of their plan’s participants and beneficiaries.

Plan sponsors considering the adoption of auto portability must determine that, by participating in the auto portability program, they are acting prudently and solely in the interests of their plan’s participants and beneficiaries.

Pairing 401(k) Savings Preservation and Expanded Access for America’s Minorities

Over the past few years, we’ve written extensively about auto portability -- what it is, how it works and the significant, positive impact it will have on the retirement security of working Americans. Our positions have been supported by research, predictive models (including EBRI’s RSPM) and real-world results from the initial implementation of auto portability.

Over the past few years, we’ve written extensively about auto portability -- what it is, how it works and the significant, positive impact it will have on the retirement security of working Americans. Our positions have been supported by research, predictive models (including EBRI’s RSPM) and real-world results from the initial implementation of auto portability.

In this article, we address an important retirement public policy question: How would a pairing of auto portability with open multiple employer plans (or “open MEPs”) impact the retirement savings of America’s minorities, and particularly, African-Americans?

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?