-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

Consolidation: Make the Smart Decision the Easiest Decision

“Make the smart decision the easiest decision” seems like an obvious goal for plan sponsors when designing participant-directed retirement plans, and it’s certainly driven the rapid adoption of the autos—auto enrollment, auto deferral escalation, and auto investment options, such as target-date funds and managed accounts.

“Make the smart decision the easiest decision” seems like an obvious goal for plan sponsors when designing participant-directed retirement plans, and it’s certainly driven the rapid adoption of the autos—auto enrollment, auto deferral escalation, and auto investment options, such as target-date funds and managed accounts.

Making Your Day, Re-Visited: When Retirement Savers’ Luck Runs Out

In his most recent article in MarketWatch, "Are you still feeling luck, 401(k) saver?" RCH’s Spencer Williams reprises last year’s 7/10/15 article where he channeled Clint Eastwood’s iconic movie hero “Dirty Harry” Callahan. Just like the movie villains whose luck ran out at the hands of Dirty Harry, retirement savers who strand their 401(k) accounts must run a gauntlet of decidedly unlucky outcomes – including involuntary cashouts, automatic rollovers and savings-depleting fees.

In his most recent article in MarketWatch, "Are you still feeling luck, 401(k) saver?" RCH’s Spencer Williams reprises last year’s 7/10/15 article where he channeled Clint Eastwood’s iconic movie hero “Dirty Harry” Callahan. Just like the movie villains whose luck ran out at the hands of Dirty Harry, retirement savers who strand their 401(k) accounts must run a gauntlet of decidedly unlucky outcomes – including involuntary cashouts, automatic rollovers and savings-depleting fees.

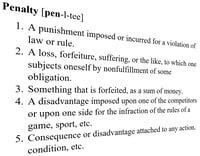

New Penalties for Lost Participants Take Effect

In November of 2015, Congress enacted the Federal Civil Monetary Penalties Inflation Adjustment Act Improvements Act to apply inflation adjustments to various penalties defined under the Federal Civil Inflation Adjustment Act of 1990. One of those penalties was the $10 per employee penalty for failure to furnish reports to certain former participants and beneficiaries or maintain records. The new penalty, as published in the Federal Register (Table C), is now $28 per employee, effective August 1, 2016.

Why Small Balance Cash Outs Are Falling Through the Cracks

According to the recently released 2016 Willis Towers Watson U.S. Retirement Governance Survey, a major trend in retirement plan governance is the growing concern employers have for employees’ retirement benefit adequacy and financial well-being. To address this concern, sponsors indicated plans to increase monitoring of participant behaviors, using metrics such as plan participation and contribution rates, as well as carefully tracking the performance of their plans’ investment managers.

According to the recently released 2016 Willis Towers Watson U.S. Retirement Governance Survey, a major trend in retirement plan governance is the growing concern employers have for employees’ retirement benefit adequacy and financial well-being. To address this concern, sponsors indicated plans to increase monitoring of participant behaviors, using metrics such as plan participation and contribution rates, as well as carefully tracking the performance of their plans’ investment managers.

Brexit Reminds Retirement-Savers Why Account Consolidation is Important

In his most recent article in MarketWatch, RCH’s Spencer Williams cites the recent market trauma experienced in the wake of the United Kingdom’s decision to exit the European Union (“Brexit”) as a good reason for retirement-savers to consolidate their accounts.

In his most recent article in MarketWatch, RCH’s Spencer Williams cites the recent market trauma experienced in the wake of the United Kingdom’s decision to exit the European Union (“Brexit”) as a good reason for retirement-savers to consolidate their accounts.

When it Comes to Saving for Retirement, Millennials Can Learn from Baby Boomers’ Mistakes

In his 6/30/16 MarketWatch article, RCH President and CEO Spencer Williams suggests an inter-generational dialogue on the pitfalls to avoid when saving for retirement.

In his 6/30/16 MarketWatch article, RCH President and CEO Spencer Williams suggests an inter-generational dialogue on the pitfalls to avoid when saving for retirement.

Calls for Portability Solutions to Curb Cash Out Leakage Growing Louder

Cash out leakage – the premature withdrawal of retirement savings for non-retirement expenses – is a persistent problem in the retirement industry, and growing more pervasive as employee mobility increases.

Cash out leakage – the premature withdrawal of retirement savings for non-retirement expenses – is a persistent problem in the retirement industry, and growing more pervasive as employee mobility increases.

Advice college graduates won't hear at commencement: ‘Strive for 25’

As they set out into the working world, RCH President & CEO Spencer Williams counsels the Class of 2016 on the importance of developing good saving habits from the very beginning.

As they set out into the working world, RCH President & CEO Spencer Williams counsels the Class of 2016 on the importance of developing good saving habits from the very beginning.

What you won’t hear in commencement addresses

Roll-In Services are a Slam Dunk for Sponsors & Participants

In his April 1st, 2016 article in MarketWatch, RCH’s CEO Spencer Williams describes the sting that retirement savers feel -- not once, but twice -- when they choose to cash out their 401(k) savings.

In his April 1st, 2016 article in MarketWatch, RCH’s CEO Spencer Williams describes the sting that retirement savers feel -- not once, but twice -- when they choose to cash out their 401(k) savings.

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?