Consolidation Corner

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?

Stale Dated Checks

Consolidation Corner Blog

Consolidation Corner is the Retirement Clearinghouse (RCH) blog, and features the latest articles and bylines from our executives, addressing important retirement savings portability topics.

A More-Enlightened Approach to Uncashed Distribution Checks

No retirement plan sponsor likes the idea of dealing with uncashed distribution checks, nor do they wish to draw unwanted regulatory attention or to become embroiled in costly litigation because of their uncashed check policies.

No retirement plan sponsor likes the idea of dealing with uncashed distribution checks, nor do they wish to draw unwanted regulatory attention or to become embroiled in costly litigation because of their uncashed check policies.

Unfortunately, many plan sponsors place themselves in precisely that spot, becoming unnecessarily over-burdened with unresolved uncashed checks, while inviting unwanted regulatory scrutiny and/or legal challenges by embracing flawed uncashed check policies.

A more-enlightened approach to managing the problem of uncashed checks seeks to minimize their numbers, while simultaneously steering clear of the “red flags” that could land them in hot water.

Bringing Clarity to the Murky Problem of Missing Participants

On October 2nd, 2017, the American Benefits Council delivered a letter to the Department of Labor (DoL), urging the DoL to act on the problem of unresponsive or missing participants, an issue that has proven to be a significant point-of-pain for plan sponsors.

On October 2nd, 2017, the American Benefits Council delivered a letter to the Department of Labor (DoL), urging the DoL to act on the problem of unresponsive or missing participants, an issue that has proven to be a significant point-of-pain for plan sponsors.

The Explosion of Small 401(k) Accounts

It’s generally accepted that the small-balance accounts of terminated 401(k) plan participants have been a problem for plan sponsors, resulting in increased plan costs, fiduciary risk and other ancillary problems, such as missing participants and uncashed distribution checks.

It’s generally accepted that the small-balance accounts of terminated 401(k) plan participants have been a problem for plan sponsors, resulting in increased plan costs, fiduciary risk and other ancillary problems, such as missing participants and uncashed distribution checks.

Now, based on new information from EBRI and other sources, we’re learning that small accounts are a large and growing problem for active participants as well.

Uncashed Distribution Checks: An Ounce of Prevention is Worth a Pound of Cure

Now that we’re in the thick of flu season, we’re reminded of Ben Franklin’s famous axiom: “an ounce of prevention is worth a pound of cure.” A yearly flu shot is perhaps the best example of an effective, preventative action you can take to minimize your odds of catching the flu, and keep you breathing more easily than those who haven’t.

Now that we’re in the thick of flu season, we’re reminded of Ben Franklin’s famous axiom: “an ounce of prevention is worth a pound of cure.” A yearly flu shot is perhaps the best example of an effective, preventative action you can take to minimize your odds of catching the flu, and keep you breathing more easily than those who haven’t.

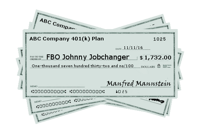

The ABCs of Uncashed 401(k) Distribution Checks

This video presentation is designed to give the viewer a basic understanding of the problem of uncashed 401(k) distribution checks.

This video presentation is designed to give the viewer a basic understanding of the problem of uncashed 401(k) distribution checks.

Five Common Misconceptions About Automatic Rollovers

Automatic rollover programs allow plan sponsors to force out of their plan separated participants with balances less than $5,000 into a Safe Harbor IRA. These programs can be quite effective at helping sponsors resolve many of the problems associated with housing small-balance accounts in-plan, such as:

-

Blog

- 401k Cash Outs

- 401k Consolidation

- 401k Plan Termination

- America's Mobile Workforce

- Assisted Roll-in

- Auto Enrollment

- Auto Portability

- Auto Portability Simulation

- Automatic Roll-In

- Automatic Rollover

- Automatic Rollovers

- Boston Research Technologies

- CARES act

- Common Mistakes

- DIY Roll-In

- DOL Advisory Opinion

- EBRI

- Employee Benefit News

- ERISA Advisory Council

- Financial Services Roundtable

- Financial Wellness

- How-To

- In-Plan Consolidation

- Leakage

- Lifetime Plan Participation

- Lost Participants

- Managed Portability

- Mandatory Distributions

- MarketWatch

- Missing Participant IRA

- Missing Participants

- National Retirement Savings Cash Out Clock

- Participant Transition Management

- PLANSPONSOR

- Portability Services Network

- PSCA

- Public Policy

- RCH Services

- Retirement Income

- Retirement Plan Portability

- retirement research

- Retirement Savings Consolidation

- Retirement Savings Portability

- Roll-In

- Safe Harbor IRA

- Saver's Match

- Security

- Small Accounts

- Stale Dated Checks

- Synthetic Tenure

- Uncashed Check Services

- Uncashed Distribution Checks

- Video

- Webcast

- What is a Missing Participant?