Past proposals for an Office of the Retirement Savings Lost and Found (“Lost & Found”) offered good examples of how the federal government could serve an important, ancillary role alongside the private sector in our nation’s 401(k) system.

Past proposals for an Office of the Retirement Savings Lost and Found (“Lost & Found”) offered good examples of how the federal government could serve an important, ancillary role alongside the private sector in our nation’s 401(k) system.

However, the current proposal for a Lost & Found contained in the draft SECURE 2.0 bill goes too far by including provisions that dramatically expand its purpose, scope and scale, creating a massive, government-run repository of micro-balance accounts that would cost taxpayers hundreds of millions, while doing little to boost retirement security.

To truly move the needle on retirement security, I encourage the Congress to return to the original, pre-SECURE 2.0 Lost & Found model, and to address the broader, small-balance account problem through policies that incentivize the adoption of auto portability.

The good news is that Congress seems to be taking notice.

The Original Lost & Found Concept

In their proposed Retirement Savings Lost and Found Act, Sen. Elizabeth Warren (D-MA) and Sen. Steve Daines (R-MT), envisioned establishing a federal registry for retirement savings accounts held by terminated employees, alongside a small, but important “repository of last resort” for lost, uncashed retirement distribution checks.

Of course, not all retirement savings accounts held by former employees are lost, but the idea to create a central data registry that could be easily accessed by all Americans to locate their retirement savings accounts is a good one. That’s why the Warren-Daines bill enjoyed the support of the Pension Rights Center, American Benefits Council, the ERISA Industry Committee and the AARP.

Lost & Found Provisions in SECURE 2.0

Similar to the Warren-Daines bill, draft versions of SECURE 2.0 from both the House and Senate establish a Lost & Found that houses a central registry for former employees. However, that’s where the similarities end.

Whereas Warren-Daines identified the U.S. Treasury as the federal agency operating the Lost & Found, SECURE 2.0 would place the new unit in the Pension Benefit Guaranty Corporation (PBGC). Much more significantly, SECURE 2.0 would massively expand the scope of the Lost & Found by requiring that plan sponsors effectively transfer all sub-$1,000 balances of terminated participants who simply fail to respond to a notification, or alternatively, fail to cash a distribution check.

Practically, the outcome of these new provisions would be staggering, but yield very little in the way of public policy benefit.

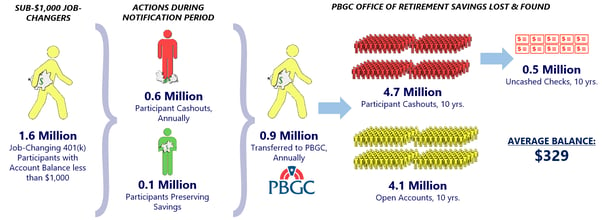

By extrapolating publicly available industry data on job-changing 401(k) participants, combined with known behavioral profiles of participants at these balance levels, my conservative calculations project that a PBGC repository for micro-balance accounts could quickly become an ever-growing, constantly churning warehouse with over 4 million micro-balance accounts.

- Each year, at minimum, 1.6 million participants with account balances below $1,000 would change jobs.

- Of these, 0.7 million would take action during the initial notification period, leaving around 0.9 million participants whose balance would be transferred to the PBGC.

- Allowing for post-transfer cashouts and redemptions, plus ongoing annual account creation would result in a build-up of 4.1 million accounts in the PBGC repository by year 10, which I further estimate would have an average account balance of $329.

Figure One: PBGC Sub-$1,000 Account Repository Model

Ironically, the high levels of ongoing account creation and subsequent requests for cashout distributions would guarantee that the problem of uncashed distribution checks would remain, albeit within the domain of the federal government. By year 10, I estimate that there would be approximately 0.5 million unresolved, uncashed checks in the proposed PBGC Lost & Found.

Even if the PBGC accounts were structured as “free” to former participants, significant funding would be required to design, implement and operate the PBGC account repository that could rival (at least in terms of numbers of accounts) the size of some of the largest 401(k) recordkeepers.

In summary projections shown on page 2, line item 6, a 5/3/2021 impact analysis by the Joint Committee on Taxation projects the 10-year “negative revenue impact” of the Lost & Found at $410 million. Based on my model’s projections, I believe that estimate is quite low.

In summary, the measure would require enormous taxpayer expense to create and operate a centralized warehouse of micro accounts, yet it would not discourage participant cashout behaviors, it would not promote consolidation of retirement savings, nor would it reduce the incidence of uncashed checks.

For these reasons, I strongly encourage the Congress, in its wisdom, to reconsider these provisions of SECURE 2.0.

A Better Solution: An Infrastructure Project That Saves Trillions

For as long as small balance 401(k) accounts are treated as problems to be disposed of, either by automatically cashing them out or by exiling them elsewhere, we’re going to get the same results – large numbers of cashouts, missing participants and uncashed checks.

Auto portability takes a fundamentally different approach. By changing the default to ‘recycling’ – where small accounts are automatically located, matched and transferred to current-employers’ retirement savings plans, a substantial portion of these micro-balance accounts are preserved within the 401(k) system, helping to fuel larger balances and to boost retirement security for millions.

The infrastructure for auto portability is already in place, and adoption has begun. The Employee Benefit Research Institute (EBRI) has estimated that the value of adopting auto portability for accounts less than $5,000 is $1.5 trillion. What’s more, by preserving retirement savings and keeping them in the retirement system, auto portability benefits participants, plan sponsors and providers, while costing taxpayers absolutely nothing.

There are now encouraging signs that legislators clearly understand this. In a 5/13/21 hearing by the U.S. Senate’s Committee on Health, Education, Labor and Pensions (HELP), the issue of solving cashout leakage as well as auto portability, were both prominently featured, and legislative initiatives that are supportive of auto portability could soon be forthcoming.