Auto portability can’t wait.

Auto portability can’t wait.

There are four key reasons why the new plan feature that automatically moves small balance retirement savings forward as 401(k) participants change jobs can wait no longer.

- Cashout leakage isn’t waiting. Every year, it decimates retirement savings for millions more under-saved and under-served Americans. For them, auto portability is the answer.

- The “Great Resignation” is accelerating, exacerbating cashout leakage in the short- and medium-term. To avert disaster, auto portability has the potential to transform the “Great Resignation” into the “Great Consolidation.”

- Policy initiatives that expand access to workplace retirement savings plans will never fully realize their intended benefits until they’re paired with auto portability.

- Auto portability is here, right now, is already working and is coming online with at least two large defined contribution recordkeepers this year and next, who collectively serve almost 10 million participants.

Reason #1: Cashout Leakage Isn’t Waiting

Ask yourself this question: How is it that America’s 401(k) system has effectively deployed an impressive array of behavioral science techniques to encourage virtuous behaviors including participation, saving and diversification, yet seems perfectly content with 40% of the very same folks cashing out following a job change?

From the perspective of participant outcomes, it just doesn’t make sense.

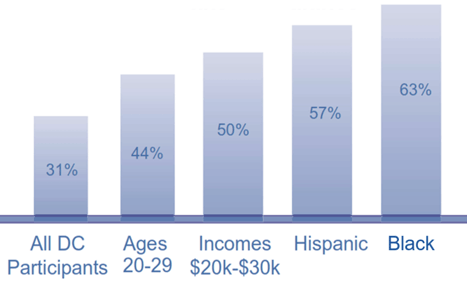

Each year, EBRI estimates that 401(k) drop-outs squander $92.4 billion in 401(k) retirement savings, with only about one-third of those cashouts due to a true financial emergency. The demographic segments that suffer the most from cashout leakage are those that can least afford it, including minorities, lower-income workers, and younger age cohorts, all cashing out at disproportionate levels, as reflected in the figure below.

Figure 1: Cashout Leakage Levels by Demographic Segment

Sources: Fidelity, Vanguard and Alight Solutions Reports on Participant Activity

Unfortunately, for most participants the full realization of the damage done to their retirement security arrives like a super-slow motion train wreck, only becoming obvious when it’s too late for them do anything about it.

Auto portability is built with financial technology, but its underlying principle is based upon behavioral science. It works by making the right choice – consolidation – the default, easy choice, fundamentally changing the dynamic for these participants and greatly reducing the odds that they’ll cash out.

Reason #2: The Great Resignation

As bad as cashout leakage has been, it’s about to get much worse as we enter a period often referred to as the “Great Resignation” as employer turnover has begun to reach unprecedented levels.

Consider the numbers: On Friday, 11/12/21, the Bureau of Labor Statistics released monthly quit rates for September, which hit 3% for the first time, after printing a record 2.9% in August. In private industry, the rate is 3.4%. Bankrate data further indicates that nearly seven in 10 Black and Hispanic Americans plan to look for a new position, compared with 47% of Whites, so the cashout leakage generated by the Great Resignation will likely impact minorities the most.

In September, 401k Specialist Editor-in-Chief John Sullivan presciently made the connection between auto portability and the Great Resignation. I concur with John and further believe that auto portability has the potential to transform the “Great Resignation” into the “Great Consolidation.”

Reason #3: Expanded Access Initiatives Require Auto Portability

Expanded access to workplace retirement savings is coming, through a combination of state and federal public policies that will continue to create more opportunities for workers to save through their employer.

These worthy and well-intentioned initiatives typically promote their benefits to minorities, women, lower-income segments, younger age cohorts and part-time or “gig” employees. Unfortunately, as previously stated, these are the same segments that cash out the most. Consequently, the needs of these under-served and under-saved segments will never be completely addressed via expanded access initiatives alone. They will also require auto portability to curb excess cashout leakage.

The Employee Benefit Research Institute (EBRI) has performed numerous projections of their Retirement Security Projection Model (RSPM), examining multiple legislative initiatives that expand access to workplace retirement savings plans. Typically, these initiatives deliver solid baseline benefits, but when auto portability is added, their benefits are dramatically increased. Every single time.

Reason #4: Auto Portability is Here, Right Now

If auto portability were just an idea, then it would simply be worthy of an intellectual debate.

However, the fact is that auto portability is already here, right now and is working. It will soon be coming online with at least two large defined contribution recordkeepers this year and next, serving almost 10 million participants. That’s an impressive accomplishment, represents a significant base to build upon, and clearly establishes auto portability as a viable, credible solution for solving cashout leakage in America’s 401(k) system.